We experienced something unusual in 2018, something we only remember occurring on two or three occasions during our time in market. A completely new sector emerged in the Australian small cap market.

The Semiconductor Equipment sector emerged in Australia in mid-2018 with the listing of little known Pivotal Systems (ASX:PVS) closely followed by Revasum (ASX:RVS). These listings provided an opportunity to look at a sector that was globally relevant, but most locally-focused investors knew very little about it. With various structural growth drivers such as the electrification of vehicles, the internet of things and big data, the sector presented very attractive long-term attributes to generate robust returns.

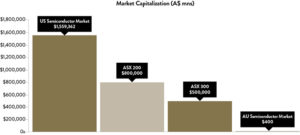

The entire US Semiconductor sector has an aggregate market value of $1.6 trillion, almost 6x larger than the ASX Small Ordinaries Index ($275 billion) and nearly as large as the entire ASX 300 ($1.9 trillion). The US Semiconductor Equipment sector has an aggregate market value of $240 billion. At the time of listing, Pivotal Systems and Revasum had a combined market cap of $450m.

At Ophir, we pride ourselves on understanding new or evolving businesses as best we can and as early as possible. Over time we have found this has delivered our investors healthy returns as we look for opportunities arising from the accelerating rate of change in businesses (or in this case a sector) that attract little attention and are not yet mainstream.

We often see the maturation of unknown businesses into the mainstream delivering significant multiple re-rates and hence outsized returns. This usually reflects a few things including:

1) Investors becoming more comfortable to pay further out for earnings as the business demonstrates consistent growth over time; and

2) Increased broker coverage and index fund buying skewing a stock’s buying demand, coupled with existing investors’ unwillingness to sell given their strong understanding of the long-term story.

As more and more US based technology companies seek listings on the ASX, with some questionably suggesting the ASX is a “Mini NASDAQ”, more companies will require this additional work and understanding. No doubt this will provide us and the market with some great investing opportunities but also some potential banana skins to avoid.

As more and more US based technology companies seek listings on the ASX, with some questionably suggesting the ASX is a “Mini NASDAQ”, more companies will require this additional work and understanding. No doubt this will provide us and the market with some great investing opportunities but also some potential banana skins to avoid.

We participated in the initial listing of Pivotal Systems with an expectation its rapid growth profile forecast at the time of listing would enable it to hold its high valuation multiple and generate strong returns. Over a 6 month period, we travelled to 3 continents and 5 separate states in the US to meet with over a dozen companies involved in the semiconductor supply chain to confirm for ourselves whether those growth projections could be achieved. This was an opportunity to develop a deep understanding of a new sector that could potentially generate outsized returns for our investors, particularly given the growth rates communicated by both newly listed companies. If these listings performed well and maintained their high multiples it was also likely additional comparable stocks would list on the ASX.

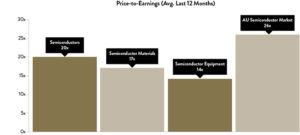

However, on closer inspection we saw areas of concern, particularly due to the wide dispersion of valuations across the global semiconductor sector, usually significantly below those multiples that both Australian listings were trading on.

Our first meeting was with a $US700m US semiconductor company in San Diego prior to the Pivotal Systems listing. We were keen to understand why this business traded on 10x PE, despite forecasting 3 years of double digit growth and having >$US150m cash which looked liked it could be deployed for M&A. The CEO’s response to our question on why their (and peer) valuations were so low was simple.

“We only have 3 months’ visibility on the majority of our revenue” and “our orders can fall away rapidly”.

That company subsequently completed an accretive acquisition and went up 35-40% from when we met, only to then fall 50% when its orders fell away rapidly, as the CEO had forewarned 12 months earlier.

That was our first exposure to the semiconductor sector outside the bubble of the ASX and we met several similar businesses over time on separate trips to Long Island, Las Vegas, San Francisco, Dallas and Germany. Most shared similar success stories… and battle scars.

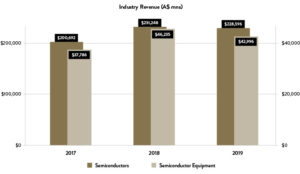

We met Veeco Instruments in Long Island, a $700m semiconductor equipment company that eventually saw revenue go from +70% growth in 1Q18 to -30% declines by 4Q19. They were less than upbeat about the global visibility of semiconductor equipment orders, referencing concerns on new technology adoption and Chinese competition.

We met Ichor Holdings in Las Vegas, another $700m semiconductor equipment company that was seeing significant order book deferrals, but was guiding the market that their largest customer had “caught a cold” and expected a 2H recovery from their temporary “illness”. The first issue with that ‘cold’? Their biggest customer was seeing revenue decline 25% QoQ in the September quarter. The second issue? Pivotal Systems shared the same large customer. Ichor subsequently downgraded earnings by 30% the next week and traded down to a PE multiple of just 7x.

We exited our position in Pivotal after Ichor downgraded, observing a slowdown in customer orders, learning, as the first CEO we met said, “orders can fall away rapidly”. Semiconductors (the actual chips) tend to have very small annual declines, even in a slowdown. However, semiconductor equipment is much more volatile, with industry declines forecasted at 7-10% in 2019 and this reduced spending cascading downwards to smaller suppliers (declines of 20-25%). That certainly translated to “orders falling away rapidly”.

In the end, the extra work and travel were worth it, largely from avoiding losses as opposed to making returns. Although we generated a positive return on our investment due to the timing of our exit, Pivotal Systems is down 60% since it peaked in September 2018 and Revasum, which we did not participate in, is down 33% since it peaked on its listing day of 3rd December 2018. A reminder for us that whilst as investors we will make mistakes, they can be limited by doing the extra work. This is something we pride ourselves on at Ophir and something we believe has been crucial to us delivering strong long term returns for our investors.

Although the semiconductor sector has not yet blossomed here in Australia, our process has uncovered several other opportunities which can benefit from technological advances in the semiconductor space. More to come on this in future installments of ‘Tray Table Insights’.