By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

The global plumbing industry is being disrupted by ‘push to connect’ components which provide a more efficient solution than the traditional soldering process. We showcase how portfolio holding Reliance Worldwide Corporation (ASX:RWC) is taking advantage of this structural tailwind and why we expect further market gains.

Welcome to the March 2019 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Month in review

Whilst unable to keep pace with the surge since the turn of 2019, global equity markets have still managed to enjoy moderate gains during March. Momentum has seemingly been unfazed by the backdrop of an inverted US yield curve (more on that later!), the UK Parliament’s rejection of Theresa May’s umpteenth Brexit deal and an ongoing US-China trade deal Mexican standoff. The FTSE 100 and the Euro Stoxx 50 led the charge among developed markets climbing 3.3% and 1.9% respectively.

On local shores, the gains in March were less notable. Whilst the ASX 200 gained only 0.2% it still delivered its strongest quarterly return since September 2009 with the index adding 9.5% to the end of March. Within the smaller company space, the S&P/ASX Small Ordinaries fell -0.1%. Significantly, sector returns both in the large cap and small cap space were influenced heavily by sharp falls in 10 year US Treasury bond yields which were down 33bps to 2.42% and 10 year Australian bond yields which were down 33bps to 1.77%. This benefitted the yield sensitive REIT sector which rose 6.0% within the ASX 200 but negatively impacted those sectors dependent on the underlying economic cycle to generate earnings such as energy and financials, which fell 4.7% and 2.8% respectively within the ASX 200.

We continue to remain cautious of businesses exposed to the Australian economic cycle and focus on those businesses that can grow irrespective of economic conditions.

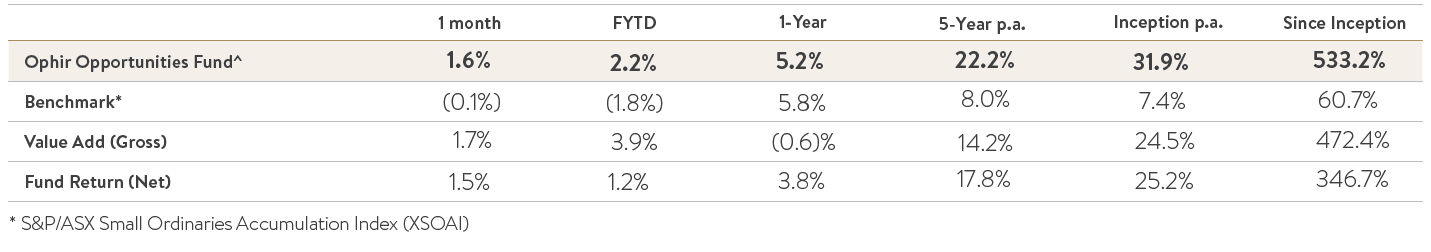

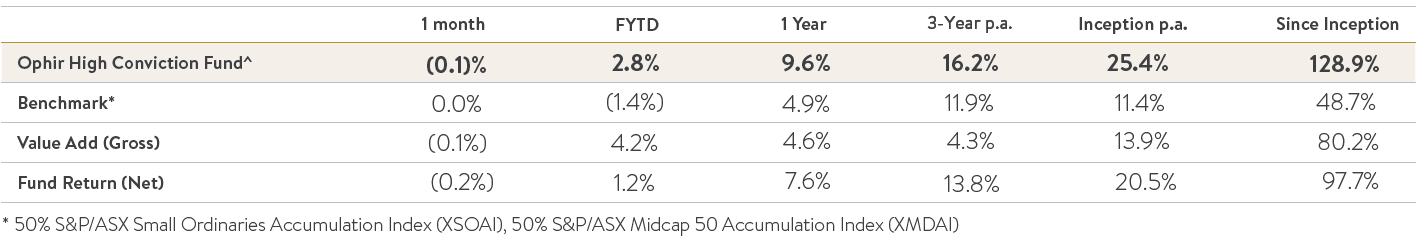

Pleasingly, the Ophir Opportunities Fund returned 1.5% after fees, outperforming the ASX Small Ordinaries Index by 1.7%. After a strong February, the Ophir High Conviction Fund was marginally down (-0.1%) against a flat benchmark.

Yet another risk to the retail sector

With a federal election looking likely in May, Australian political watchers were focussed on the New South Wales state election. The election pitted the Premier and Coalition leader Gladys Berejiklian campaigning on the strong recent performance of the NSW economy, including the record low unemployment rate, against newly elected Labor leader Michael Daley’s ‘schools and hospitals before stadiums’ ticket. New South Wales voters ultimately returned the Coalition by a slim one seat majority in what was seen as both an endorsement of the Premier’s sensible government approach as much as a riposte to the Labor leader’s series of gaffes during the campaign’s final weeks. Despite the New South Wales state election result, the Bill Shorten led Labor opposition remain firm favourites to clinch power with a majority of seats at the federal election. In fact, the odds of a Labor Government have only ‘Shorten’ed since the New South Wales state election and at the time of writing Australian online bookmaker Sportsbet was offering odds of $1.15 for a Labor majority and $5.00 for a Coalition majority.

The strong possibility of a federal Labor government is something we are factoring into the sectors and business that we choose to allocate capital to within the Ophir portfolios. Whilst there has been much media attention on the potential impact of long-standing Labor policies of limiting negative gearing to new housing only and halving the capital gains discount to 25% on newly acquired assets, our analysis indicates the impact of these reforms on the housing sector are unlikely to be significant.

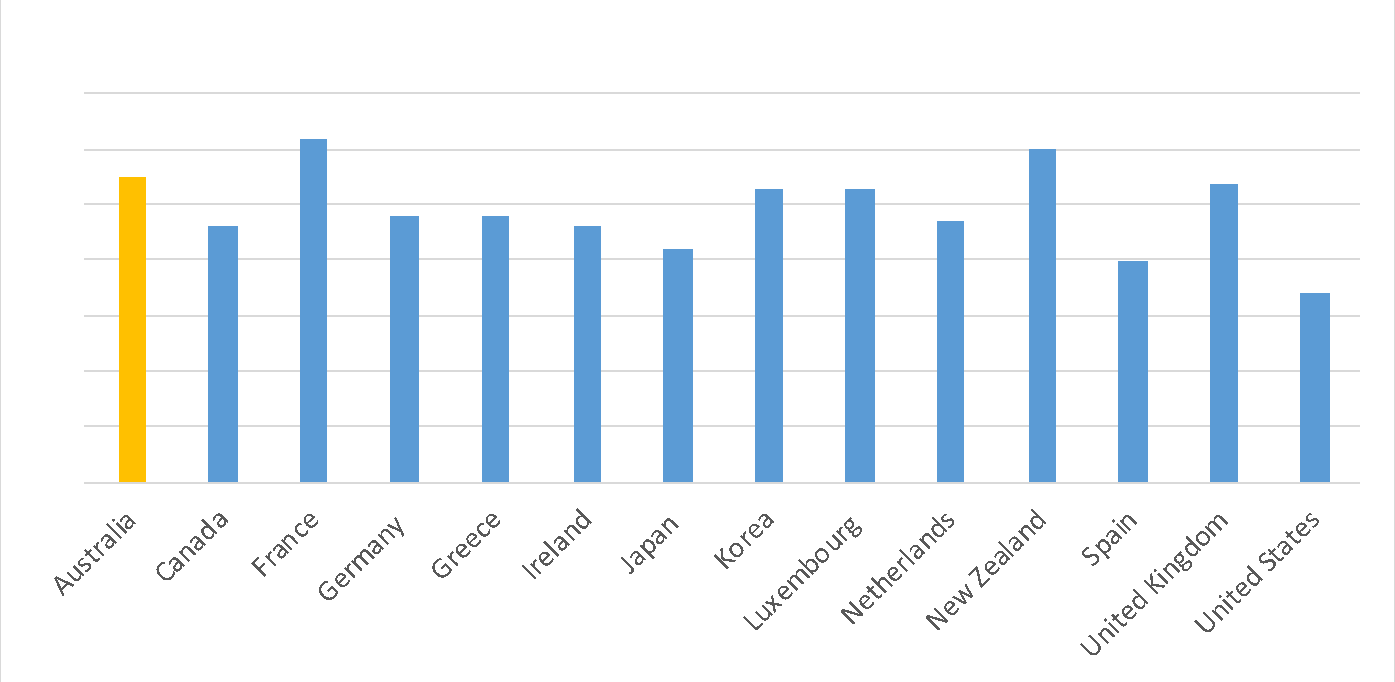

We are more concerned, however, with the impact that Labor’s ‘living wage’ policy could have on Australian retailers at a time when the sector is already facing multiple headwinds in the form of the negative wealth effect of falling house prices acting as a drag on householder consumption, and continued disruption from online retailers such as Amazon. When viewed in a global context, this policy further disadvantages retailers on our shores where the minimum wage already compares favourably to peers in other developed economies. As a result, whilst we continue to hold some retail businesses within the Ophir portfolios where we hold conviction that the valuation represents the available growth on offer, overall we currently view the retail sector with some caution despite the sector’s relatively low price/earnings multiple.

Source: OECD 2017

Continued focus on businesses with earnings resilience

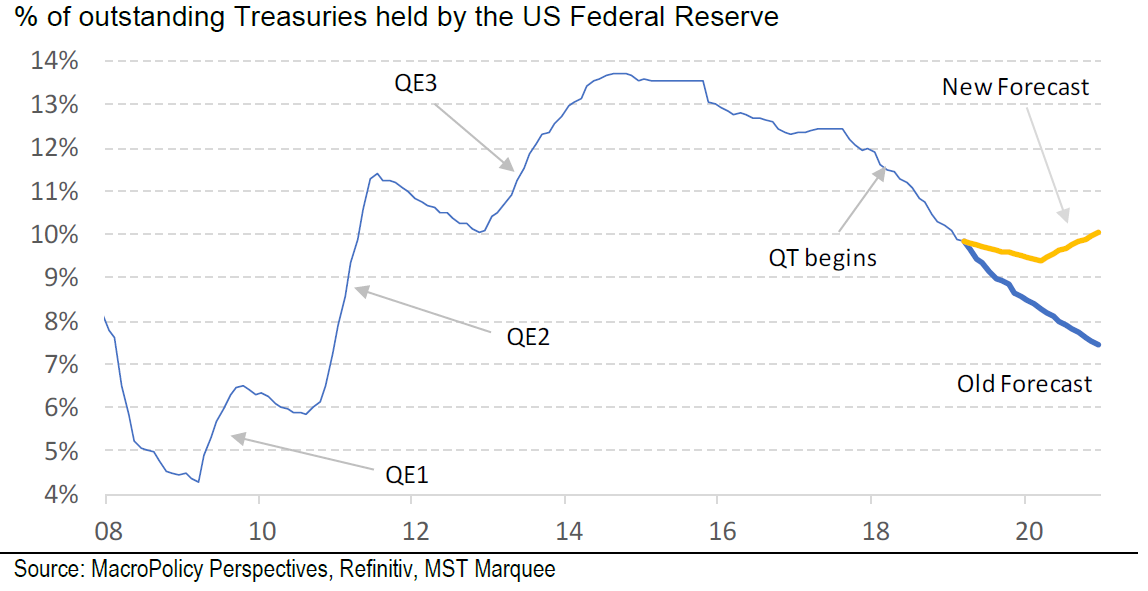

On Friday March 19th Google searches for the phrase ‘yield curve’ spiked when the yield on the US 10-year Treasury note fell below the 3-month Treasury yield for the first time in over a decade. When long term bond yields fall below short term rates you have what is called an ‘inverted’ yield curve. This was sparked by comments from the Federal Open Market Committee that it won’t be raising rates again this year and that it would halt the decline of its balance sheet in September in response to signs of an economic slowdown.

Despite an ‘inverted’ US yield curve preceding every US recession since World War II, in our view any concerns that a US recession is imminent are exaggerated as we are currently not witnessing any of the exuberance that foreshadows a US recession such as inflationary pressure, wage growth and household indebtedness. A flattening yield curve is more likely to be foreshadowing continued subdued economic growth and macroeconomic uncertainty which for us as investors means a continued focus on businesses that are more economically resilient. One example of such a business is portfolio holding Reliance Worldwide Corporation Ltd (ASX:RWC).

For those unfamiliar with their business, Reliance is a plumbing parts business that manufactures and distributes ‘push to connect’ (PTC) plumbing components. By allowing plumbers to simply cut both sides of a damaged brass pipe (used in the US) or plastic pipe (more common in Australia and the UK) and connect, these components are disrupting the plumbing industry by providing a quicker and more efficient solution than the traditional, more labour intensive soldering process.

The combination of structural growth tailwinds and exposure to the defensive repair and remodelling segment of the market is what attracted us to the company. Reliance owns the dominant PTC brands in each of Australia and the US (‘SharkBite’) and the UK (‘John Guest’) and there is significant opportunity for continued growth, particularly in offshore markets. For instance, in the US, PTC brass fittings only have ~13% market penetration and are growing at a double digit rate vs low single digit growth in the overall plumbing category. Given the value equation to plumbers who use PTC vs traditional methods, we expect further market share gains for many years to come, particularly as labor costs continue to rise.

The company has de-rated significantly from the highs reached soon after the acquisition of John Guest in the UK. The company has been caught up in a general malaise surrounding a slowdown in US housing, Brexit and concerns of potential destocking by a key customer after Reliance made the decision to cut its exclusivity. We initiated our position following this initial de-rate, however, the stock has de-rated further following the recent former Chairman’s selldown and retirement. To put it into context, Reliance’s rolling 1-year forward price earnings multiple has fallen from a high of ~25x to currently ~18x.

Importantly, we believe these concerns are unfounded and there has been no discernable change in the earnings power of the company to warrant this level of de-rate. Reliance is a resilient business that we believe has limited exposure to the US economic cycle given it is mainly used in emergency repairs and its exposure to new house builds is very low. Furthermore, the decision to broaden its presence in the US to more customers (now sold in Lowes and not just Home Depot) has improved the overall growth prospects of the business, particularly considering the market share gains being made by Lowes in recent quarters. Discussions with key customers have further re-enforced our view of the quality of brand, franchise and management’s capabilities.

It is these types of business that display an ability to grow offshore or independently of the economic cycle that we continue to focus on within the Ophir portfolios, particularly given our expectations that the outlook for equity markets will remain choppy and the outlook for the Australian economy near-term remains challenging.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Portfolio Managers

Ophir Asset Management

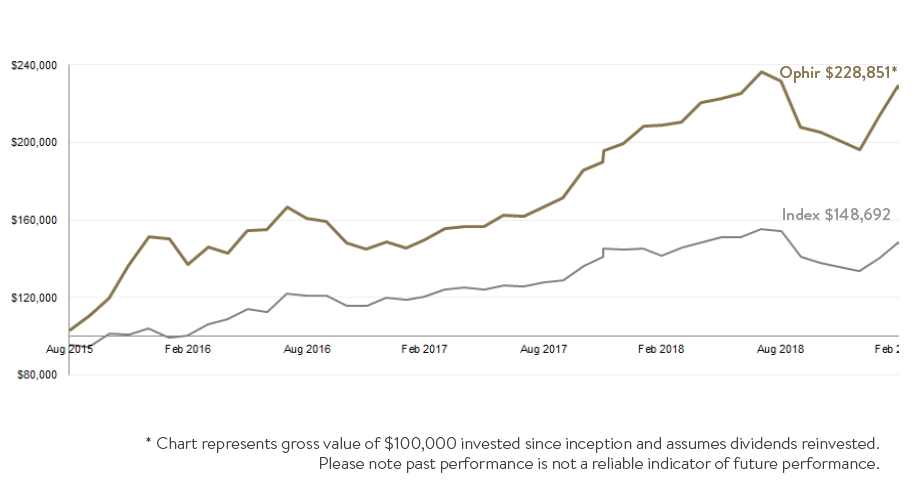

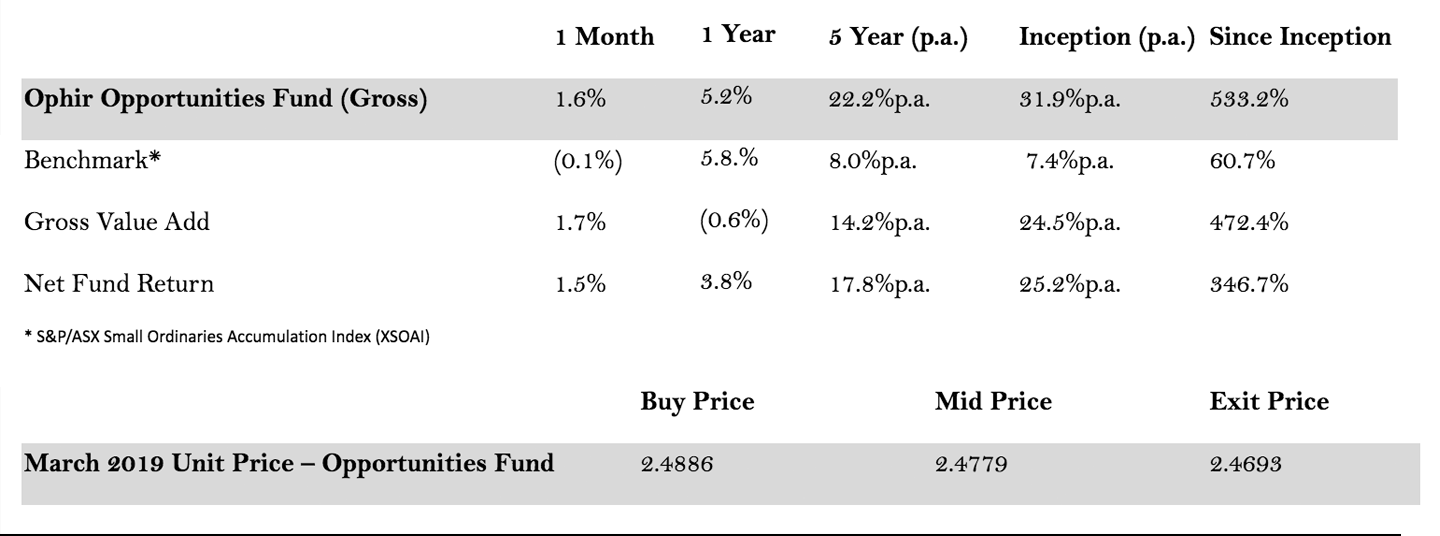

The Ophir Opportunities Fund

Growth of A$100,000 (pre all fees) since Inception

The Ophir Opportunities Fund returned +1.6% for the month (gross), outperforming the benchmark by 1.7%. Since inception, the Fund has returned +31.9% per annum (gross), outperforming the benchmark by 24.5% per annum.

Key contributors to the Opportunities Fund performance this month included Jumbo Interactive (JIN), Afterpay Touch (APT) and Integrated Research (IRI). Key detractors included IMF Bentham (IMF), Freedom Foods (FNP) and Seven Group Holdings (SVW).

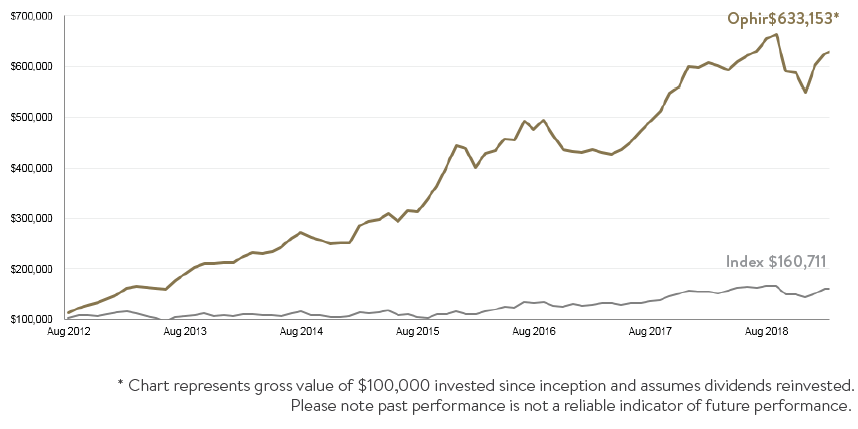

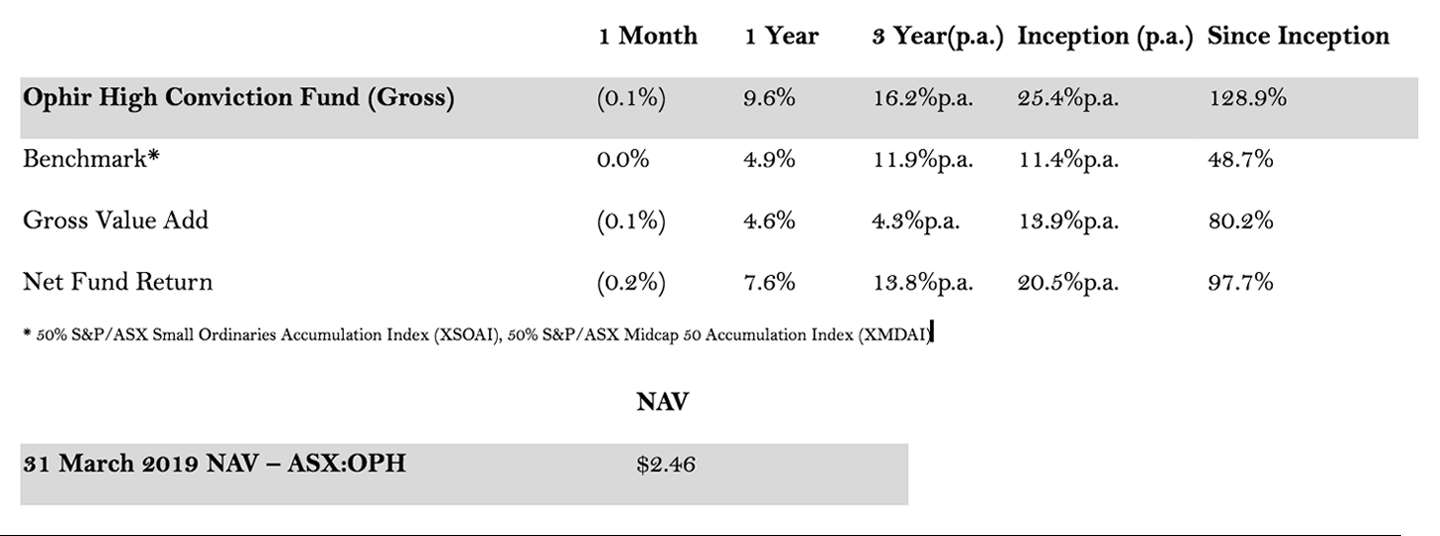

The Ophir High Conviction Fund

Growth of A$100,000 (pre all fees) since Inception

The Ophir High Conviction Fund returned (0.01%) for the month (gross), underperfoming the benchmark by (0.01%). Since inception, the Fund has returned +25.4% per annum (gross), outperforming the benchmark by 13.9% per annum.

Key contributors to the High Conviction Fund performance this month Afterpay Touch (APT), Cleanaway (CWY) and Mineral Resources (MIN). Key detractors included Seven Group Holdings (SVW), Freedom Foods (FNP) and Webjet (WEB).

Image source: Plumbing Supply and Sharkbite

This document is issued by Ophir Asset Management (AFSL 420 082) in relation to the Ophir Opportunities Fund & the Ophir High Conviction Fund (the Funds) and is intended for wholesale investors only. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir Asset Management accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. Any investment decision in connection with the Funds should only be made based on the information contained in the Information Memorandum and/or Product Disclosure Statements.