By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our September 2019 Letter to Investors we review the significant style rotation that featured in equity markets both in Australia and overseas during the month. We then discuss our view on the causes and how we think about them in the context of the Ophir Funds.

Dear Fellow Investors,

Welcome to the September 2019 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Business Update

We established Ophir in 2012 as our primary investment vehicle for ourselves, our families, our close friends and our now growing team. As Co-Founders and Senior Portfolio Managers, we have all our liquid personal wealth invested in the Ophir funds which now represent approximately $1.2 billion in funds under management.

Following on from our two highly successful Australian small and small/mid-cap funds which have delivered a market leading 26.7% p.a. (since August 2012) and 20.5% p.a. (since August 2015) respectively since inception, we are very excited to announce the launch of the Ophir Global Opportunities Fund.

The Ophir Global Opportunities Fund is comprised of 20-50 global stocks providing investors with exposure to a diversified portfolio of emerging growth businesses, available exclusively to wholesale investors.

The Fund was seeded on 30 September 2018 and we currently manage approximately $90 million of investor capital in the Fund, raised from a select group of family, friends and long-time investors and of course a significant portion of our own capital.

The Fund has exceeded all expectations, delivering a 12-month investment return net of all fees of 31.4%. The Fund is targeting a return of 15% p.a. over the long term and while we have surpassed that in year one, we want to make sure our fellow investors’ expectations are set appropriately. We want to underpromise and overdeliver.

We will be making significant additional investments across both the Ophir Global Opportunities Fund and the Ophir High Conviction Fund this month. These funds will be our primary investment vehicles for our personal wealth into the future.

We invite long term investors to invest alongside us in the Ophir Global Opportunities Fund. Please click here to register for more information about the Fund.

Month in review

September was all about global macroeconomic news, the bond market’s reaction and flow on effects to the performance of different investing styles. With a de-escalation in US-China trade conflict, supportive monetary policy moves by key central banks and some slightly better than expected economic data releases in the US, risk-on sentiment returned to financial markets. This saw many developed market long term government bond yields in early September reverse much of their steep falls that were seen during August, and a modest steepening return to yield curves. As an example, the US and Australian 10-year bond yields rose 0.45% and 0.32% respectively by mid-September from their August lows. Such monthly volatility in bond market yields is uncommon and had material ramifications for what parts of the equity markets did well or not, during the month.

Equity markets took the few economic bright spots mentioned above and ran with them during September, generally partially reversing August’s falls in most markets. The MSCI World Developed Market Index was up 1.9%, outperforming the Emerging Markets Index which was up 1.7%. Regionally, of the major markets Japan (+5.1%) and Germany (+4.1%) led the way, whilst the US large cap S&P500 (+1.7%) and tech heavy NASDAQ (+0.5%) were the relative laggards. Emerging Markets were held back by falls in Indonesia (-2.8%) and South Africa (-2.0%), though the Argentinian stockmarket (+8.5%) recovered somewhat after falling just over 50% in August post the election defeat of its market friendly President.

At home, the S&P/ASX200 Index underperformed its developed market counterparts but still rose 1.3% and is a global standout performer over the last 12months, up 12.5% in total return terms. Small stocks clawed back some of their lost ground over the last year to larger companies with the Small Ordinaries Index up 2.0% for the month.

Ophir Fund Performance

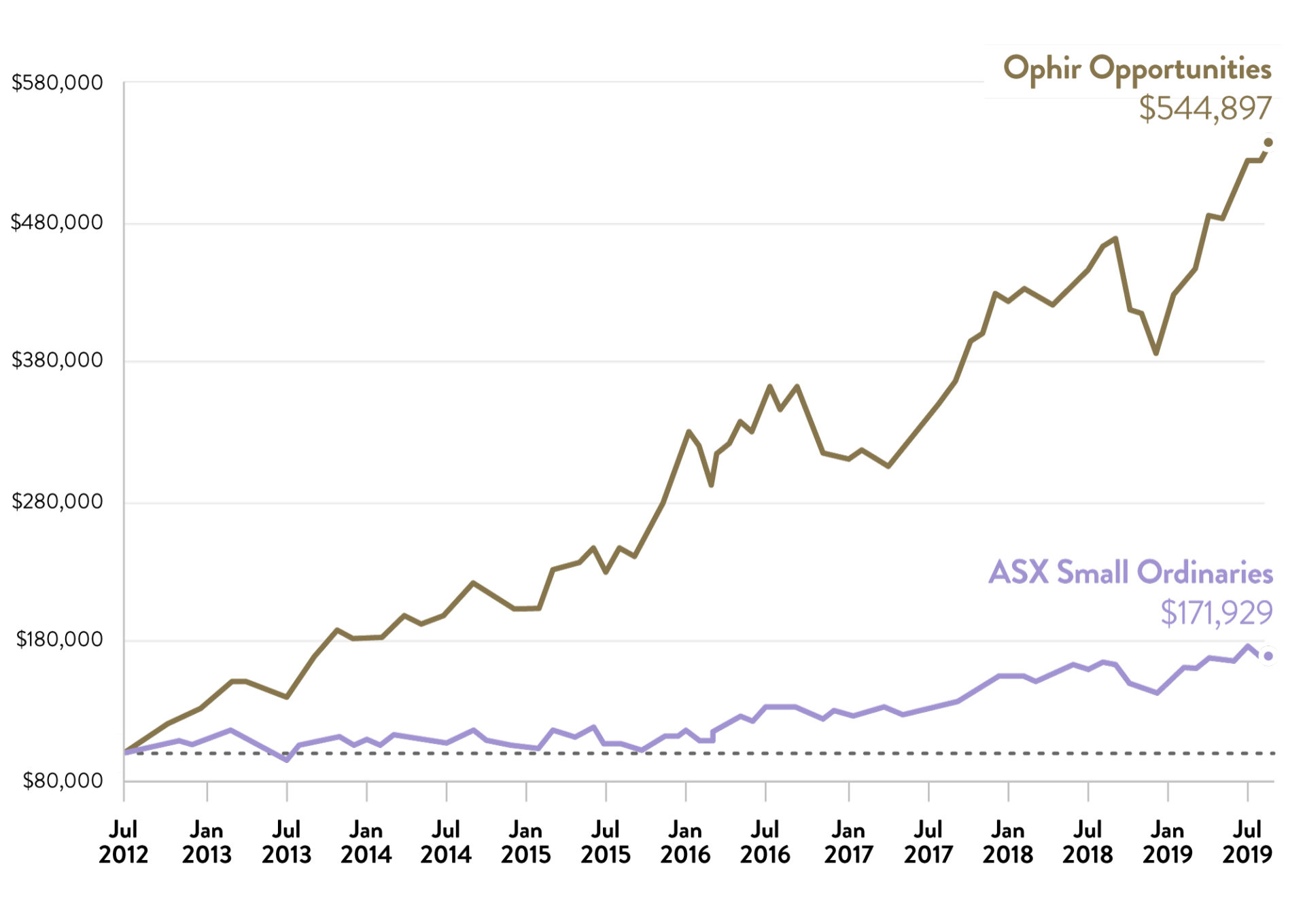

The Ophir Opportunities Fund returned 3.6% for the month after fees, outperforming its benchmark by 1.0%. Since inception, the Fund has returned +26.7% per annum after fees, outperforming its benchmark by 18.8% per annum.

Growth of A$100,000 (after all fees) since Inception

| 1 Month | 3 Month | 1 Year | 3 Year (p.a.) | 5 Year (p.a.) | Since Inception (p.a.) | |

| Ophir Opportunities Fund* | 3.9% | 9.8% | 20.9%p.a. | 17.5% | 24.9% | 33.7% |

| Benchmark* | 2.6% | 3.1% | 3.9% | 8.8% | 9.6% | 7.9% |

| Value Add (Gross) | 1.3% | 6.7% | 17.0% | 8.7% | 15.3% | 25.9% |

| Fund Return (Net) | 3.6% | 8.2% | 16.2% | 14.8% | 20.4% | 26.7% |

* S&P/ASX Small Ordinaries Accumulation Index (XSOAI). Past performance is not a reliable indicator of future performance

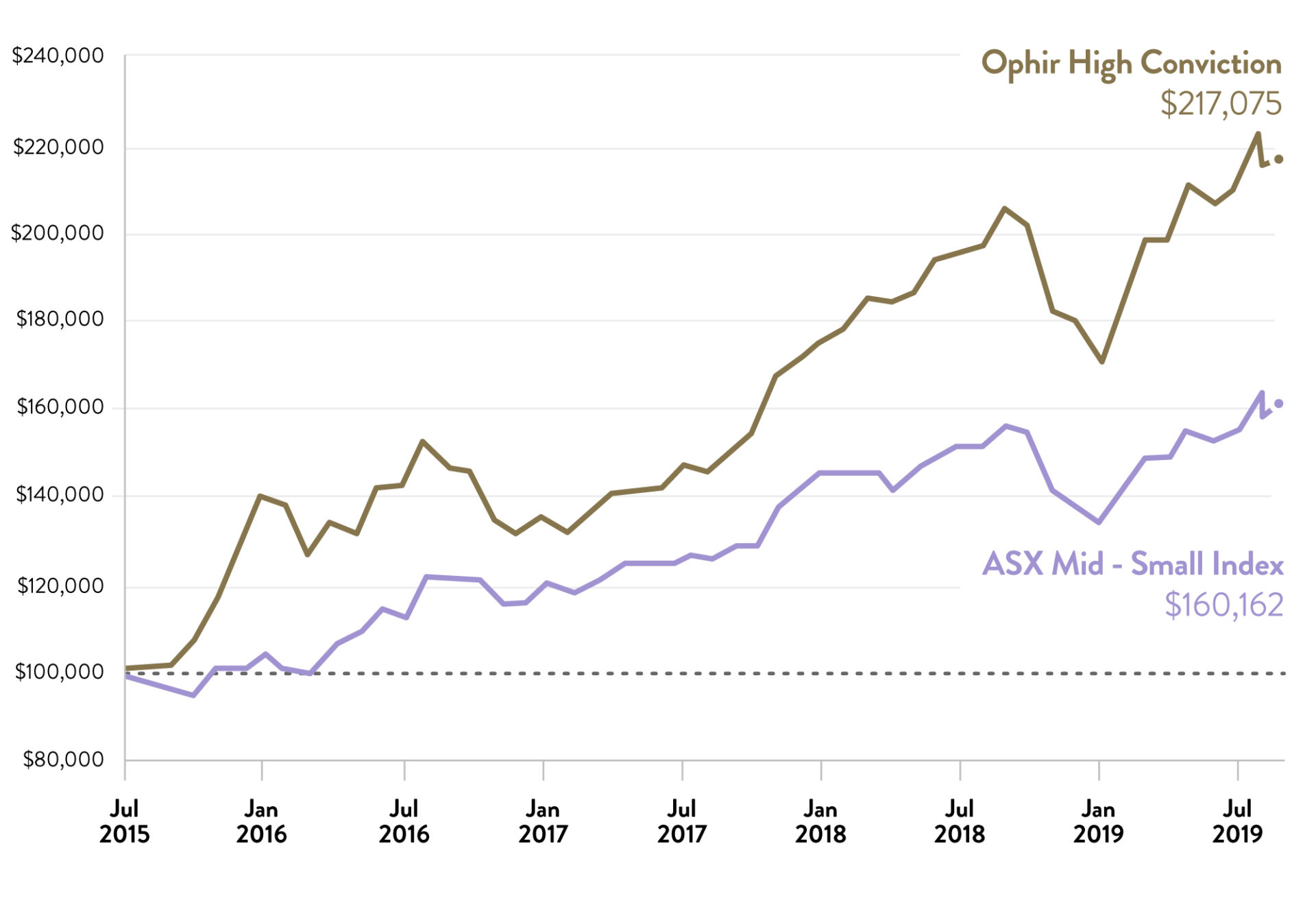

The Ophir High Conviction Fund investment portfolio returned 1.0% for the month after fees, underperforming its benchmark by -0.7%. Since inception, the Fund’s investment portfolio has returned +20.5% per annum, outperforming its benchmark by 8.5% per annum after fees. The Ophir High Conviction share price returned 2.5% for the month.

Growth of A$100,000 (after all fees) since Inception

| 1 Month | 3 Month | 1 Year | 3 Year (p.a.) | Since Inception (p.a) | |

| Ophir High Conviction Fund (Gross) | 0.9% | 4.2% | 9.6% | 16.8% | 25.1% |

| Benchmark* | 1.7% | 3.2% | 3.7% | 9.7% | 12.0% |

| Gross Value Add | -0.8% | 1.0% | 5.9% | 7.1% | 13.1% |

| Ophir High Conviction Fund (Net) | 1.0% | 3.8% | 7.4% | 14.4% | 20.5% |

| ASX:OPH Share Price Return | 2.5% | 0.4% | n/a | n/a | n/a |

* S&P/ASX Mid-Small Accumulation Index. Past performance is not a reliable indicator of future performance

Macroeconomic highlights

In key macroeconomic news, both the US Federal Reserve and the Australian RBA eased their key policy interest rates again to 1.75% and 0.75% respectively, as both their local and global economic growth rates continue to slow moderately. This trend is likely to continue as global Purchasing Manager Indices have fallen to their lowest since 2016, and suggests the slowdown continues to broaden. In Australia, markets are forecasting a better than ever chance of another cut to a 0.5% Cash Rate by the RBA by years end, with speculation rising of quantitative easing beginning in 2020. This has come as domestic GDP growth has slowed to its lowest since the GFC, and the recent modest rise in wages growth appears to have stalled. Leading indicators of the Australian economy such as business confidence and conditions have slipped recently, unwinding their post-election bump. On a more positive note house prices appear to have bottomed in the key Sydney and Melbourne markets with solid gains now seen for three consecutive months and auction clearance rates returning to buoyant levels.

In other markets, oil prices spiked more than 15% mid-month as a drone attack on Saudi oil facilities disrupted more than 5% of global oil supply, though production was restored quickly, and prices reverted lower by month end. In commodity news, the iron ore price surged 11% during the month, assisting the share price performance of relevant miners, though it still only partially reversed some of August’s big fall. For currencies, market moves were fairly muted during the month with the Australian dollar still sitting at its lowest levels against the US dollar since February 2009.

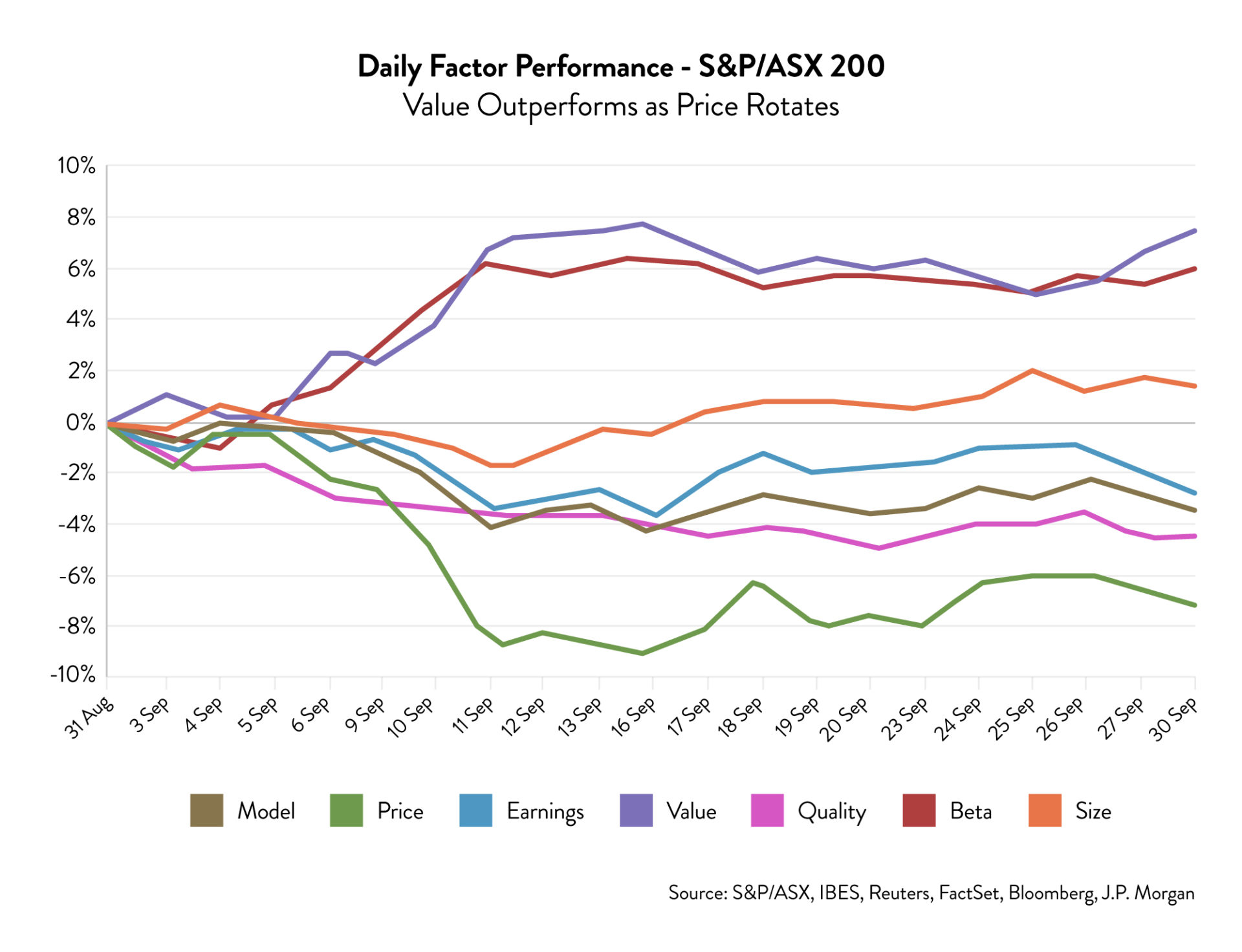

Bond market reaction and share market style rotation

Longer term bond yields for much of 2019 have headed lower in advanced economies. This came as a number of key central banks shifted 180 degrees earlier in the year from hiking to easing biases for interest rates as it became evident the global economy was slowing. August saw bond yields typically back to around either existing or reaching new all-time lows. This changed in early September as yields spiked higher on the back of some marginal macroeconomic and political bright spots. Not only did equity markets in general move higher in response, but it was value stocks that were the key beneficiary both globally and in Australia. In fact, September represented the second largest monthly outperformance globally of value stocks compared to growth stocks over the last decade. The outperformance was even more striking in Australia (3.8% outperformance compared to 3.0% globally). This occurred in the context of value underperforming significantly for much of the last 5-10 years. Notably, the month also saw momentum stocks (those whose stock prices have done well recently) underperform by even more than growth as recent winners tended to sold off strongly. A rise in correlations during the month of stocks representing a certain style suggest macro factors were driving markets more as distinct from stock specific factors.

Value stocks, that is those trading on cheaper prices compared to fundamentals such as earnings or revenues, tend to perform relatively better during early stages of economic upswings than their growth counterparts. This is due to the more pronounced effects of better economic growth on their earnings and higher interest rates (discount rates) affecting less the present value of their future earnings.

Predictably, a key value sector, Financials, was one of the best performing globally over the month, with higher long-term interest rates and a steeper yield curve benefitting the net interest margins banks earn. This came after a difficult results month for the Australian banks in August. Other standout sectors in the ASX200 during September were Energy and Materials. This came as oil and iron ore were higher in the month, with cyclicals also tending to do better during a risk on month for markets. Defensives and bond sensitive sectors such as Healthcare and REITs struggled falling -3.2% and -2.8% respectively.

The Ophir view

As a small and mid-caps manager, we are searching for growth companies that have large markets that they can grow into and compound earnings over time. This typically means looking for companies than can grow earnings at 15%+ over a long period compared to the market’s long-term average of around 5-6%. A trap however is to pay too much for high earnings growth, so we maintain a keen focus on valuations to ensure we are not overpaying.

Whilst months like September for equity markets, which are more about the macro news and strong rotations in performance across different investment styles, are important to understand, they have little impact on the way we manage the Funds at Ophir. We don’t profess to have expertise in timing different investment styles and remain focussed on finding the next growth stock early that can go on to become a household name.

That said, whilst September saw a spike in bond yields, we believe we are likely to be in a lower for longer interest rate environment for some time yet. Though there are key risks to this outlook, on balance we believe this will likely extend the current cycle and be a positive for growth stocks. This stems from our belief that key central banks will maintain, and act on as appropriate, their current easing biases to combat low inflation and economic risks currently skewed to the downside. History suggests from the Japanese and European sharemarkets that very low long-term interest rates are disproportionately good for growth stocks. This comes from two key factors:

- Lower discount rates boost valuations for growth stocks more than value

- In a lower growth world, companies that can grow earnings derive a scarcity premium

In Australia, the biggest risk to this low growth and interest rate outlook is a strong rebound in house prices preventing the RBA from cutting interest rates further. On this score we believe macro prudential measures by APRA to stem house price risks may allow the RBA to keep cutting. Tax cuts also might help reinflate the domestic economy in FY20, but the scale of the tax cuts means only a modest affect at best and with the savings rate already low a significant portion of this might be saved or used to repay debt. Fiscal stimulus is also likely to be absent as the Federal government has committed to a surplus this financial year. Globally the biggest risk we see to this outlook is a resolution to the US-China trade war, though with the US election still over a year away, we see President Trump wanting to maximise the political capital from any deal closer to election day.

Key Stock News

At the larger end of the small and mid-cap space we cover, long time holding Afterpay (ASX:APT) was the best performing stock for the month, up 15.8%, similar to its rise in August post its strong FY19 result. The company’s share price is up 94.9% on the year. Most of the monthly gain came on a trading day near the end of the month after analysts from a key brokerage house upgraded their price target for the company. On the same day Afterpay informed the market that an interim report by an external auditor on its AML/CTF procedures has been lodged with AUSTRAC and did not provide any recommendations. Making headlines also was the high-quality appointment of former US Treasury Secretary and President of Harvard University, Larry Summers, to the company’s US Advisory Board. We continue to conduct work on Afterpay’s growth trajectory in its new US and UK markets and remain excited about the traction we believe it is gaining in these new growth regions. At writing it remains a significant weight in both our Opportunities and High Conviction Funds.

Staying in the mid-cap part of the market, A2Milk (ASX: A2M) fell -10.3% during September, following falls in August post its financial results which highlighted some significant marketing and consultant investment. We wrote in further detail about the result last month and whilst the company remains a material portfolio holding and future sales prospects for its infant formula business remain outstanding, we had down weighted it pre-result as transparency into some parts of its operating expenditure had decreased.

Austal (ASX: ASB), the Western Australia headquartered global leader in aluminium ship building, has been a top contributor to performance in both our Australian equity funds over the last year, with the share price more than doubling. The price has been propelled by new contracts won and through broadening out its production of new ships in new geographies. The company made news during the month and received some free press courtesy of Donald Trump. The US President gifted visiting Australian Prime Minister Scott Morrison a model of the LCS30, the USS Canberra, designed at Austal’s Australian headquarters and built at its Mobile, Alabama facility.

We remain attracted to the defensive qualities Austal adds to our Funds. With global trade issues threatening many companies around the world, we see Austal as well placed with over 4,500 employees at its Mobile shipyard and is the largest employer in the town. US dollar revenues from government military contracts means they are well protected in a downturn. This type of government spending tends to be maintained, and in Aussie dollars is generally worth more as the global economy slows, given our currency often then depreciates. As we get later in this business cycle, finding and holding attractively valued defensively orientated growth businesses will become even more important. This is an example of how we think about the construction of the Funds and how we seek to alter their composition over time depending on what stage of the business cycle we are in.

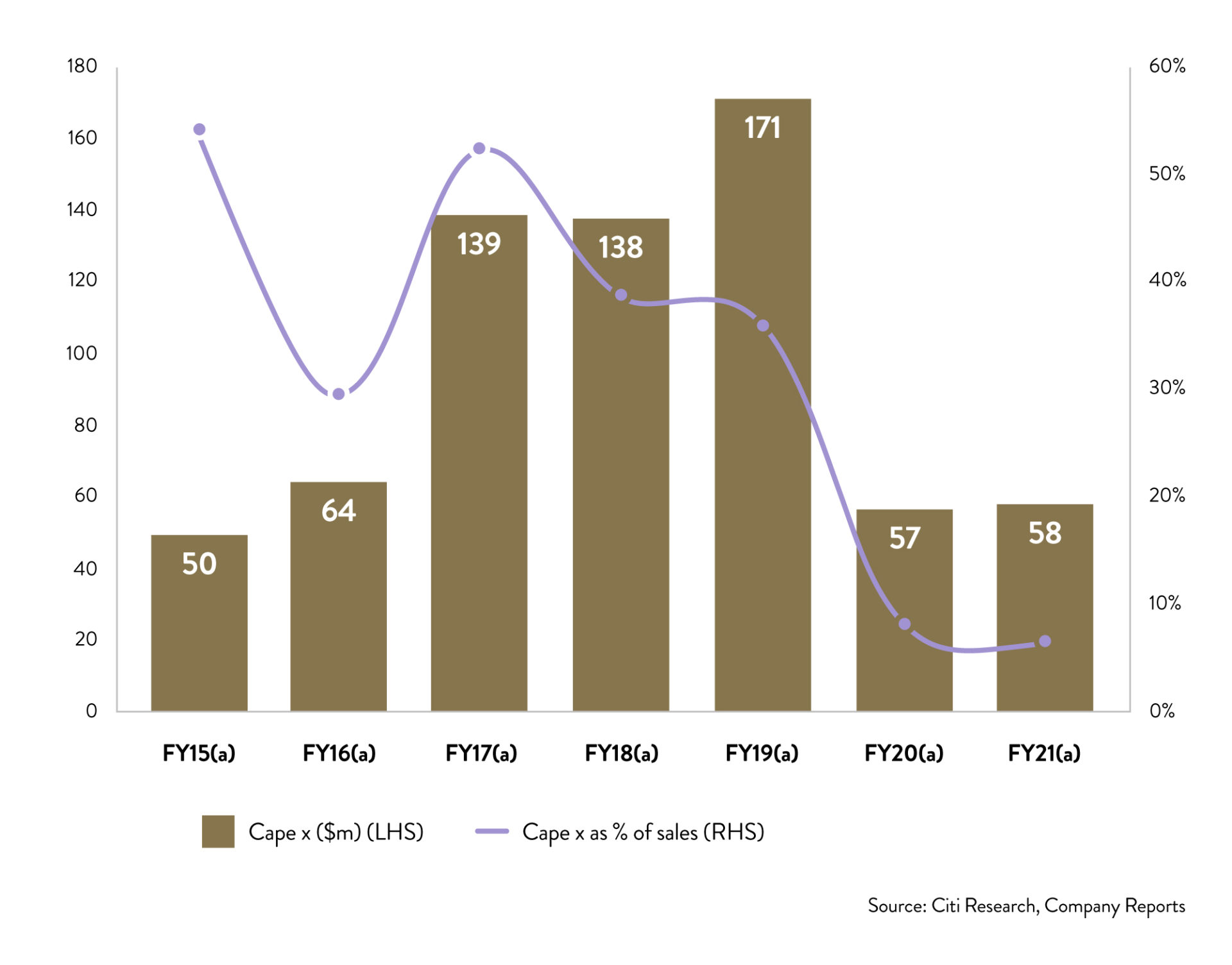

A company we remain attracted to post reporting season is Freedom Foods (ASX: FNP). It is the largest player in the healthy, low allergy and ‘free from’ section of supermarkets. Leading positions are held in gluten free cereals and plant-based milks which are some of the fastest growing categories in stores, earning high margins and are being allocated more shelf space over time. This is happening due to the structural trend of health-conscious consumers willing to spend more on healthier staples as living standards improve. It is transitioning from a private label manufacturer to a branded manufacturer with around 50% of sales now from branded products. Brands include Australia’s Own, MilkLab, Messy Monkeys and Vital Strenth, and excitingly it is the fastest growing branded supply in the Australian grocery market. These branded products earn high margins and returns for investors. Investors have had to be patient as the company has spent more than $500m on capex over the last five years expanding capacity particularly in UHT and diary nutritionals from its Shepparton facility. Much of this spend is complete and plant production is ramping up which is very positive for incremental margins given high fixed costs. A lot of the capacity expansion has been underwritten by contracts at favourable prices.

Drought has been a concern for the milk industry, but Freedom have locked in their supply with only a minimal step up in cost given the long-term supply contract nature of 3+ years. Demand for its milk products is very high, particularly in export markets in China and South East Asia where growth is accelerating fastest. Domestically there is a need for supermarkets to respond to higher input costs and the struggles of the dairy industry. Despite private label fresh milk prices rising from $1/lt to $1.20-1.30/t, UHT milk prices haven’t moved but we expect this will happen soon. A key undervalued part of the business for us is the branded plant-based milk MilkLab. It has been growing at 30%+ for many years and is a very high margin business, with very strong penetration in the café channel in Australia but still lots of runway to grow overseas.

At Ophir, we continue to focus on finding the next company that we believe can continue to take market share in a structural growing market, providing the opportunity to compound our and our investors wealth over time. We remain as hungry as ever to find an edge on these companies through going the extra mile to understand all we can about where they are today, and what they are likely to grow into tomorrow.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund & the Ophir High Conviction Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.