We review two core ways to measure investment performance, and why understanding them can have an impact on your investment behaviour.

An often-overlooked topic we come across is understanding how to correctly measure the returns investments earn. And although calculating the return of an investment portfolio would seem like a relatively simple procedure, this isn’t always the case. The fact is that there is more than one way of measuring it. And in many situations, the results will differ depending on the method chosen.

Particularly confusing can be the interrelation which exists between the size of investment returns, with the timing of those returns. So as to provide some clarity on this topic, in this article we will highlight what are known as ‘time weighted rates of return’ with that of ‘money weighted rates of return’. By contrasting these two measures, we aim to help you understand which approach is the best, depending on the use to which you intend to put the result.

Before getting into the detail, we should first highlight that time weighted returns (TWR’s) and money weighted returns (MWR’s) both operate under a wide range of commonly associated names. We have mapped out some of these below.

To explain the differences between TWR and MWR, we will use an example of an investor whom we will name Tracey.

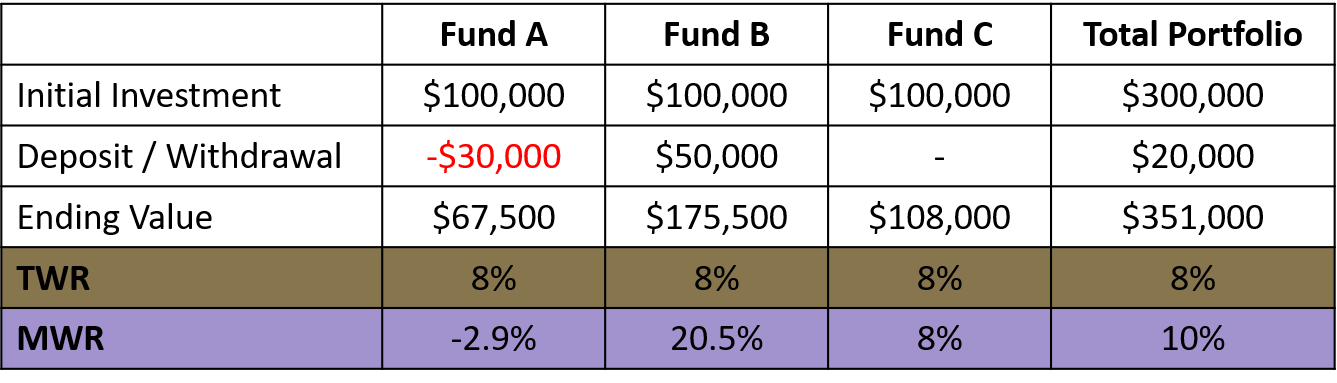

At the beginning of the year, Tracey invests $100,000 into three separate funds that are invested identically. In the first 6 months her overall portfolio which started the year at $300,000 loses 20% (so each individual fund also loses 20%). Over the final 6 months of the year the overall portfolio rises by 35% – so a “bad” first half, then a “good” second half. Let’s also assume that half way through the year, Tracey withdrew $30,000 from Fund A, and deposited $50,000 into Fund B.

The table below shows both the TWR and the MWR of each of these three funds over the full 12 month period. Returns are also shown for the overall portfolio.

The first thing you will probably notice is that the TWR is exactly the same for each of the three funds, regardless of the deposits or withdrawals. This is because it measures the overall portfolios return.

By contrast, the MWR measures the investor’s performance, which is heavily influenced by the dollar amount and timing of the deposits or withdrawals. Fund B, for example, had a large deposit right before the investment rebounded – so Tracey had more money benefiting from the recovery. For Fund A the opposite occurred, with Tracey withdrawing $30,000 just prior to the period of strong performance. This left a smaller pool of capital to benefit than if the withdrawal had not been made.

Fund C was not impacted by either deposits or withdrawals, and hence the MWR and TWR are both identical.

In summation, time-weighted returns are the more appropriate metric for fund managers, given they have limited control over how much, and when, an investor adds to or withdraws money from the fund. It follows that by removing the distortion of these cash flows, the time-weighted return provides a fairer comparison of performance with other investments and fund managers. At Ophir, and as is standard in the professional funds management industry, it is these time-weighted returns that we report in our communications with investors.

By contrast money-weighted rates of return apply different weights to different periods. What this means is that in the case of our personal investments, when it is us who decides the timing of cash inflows and outflows in each period, money-weighted returns should be used. Money-weighted returns also allow us to better assess personal portfolio performance relative to our individual financial plans and projections.

As can be seen from the example of Tracy above, it can matter a great deal for the value of your investment portfolio whether your MWR is higher or lower than the TWR that your fund manager is responsible for. For many investors, their MWR is materially less than their TWR as they withdraw money from, and add money to, their investment portfolios at precisely the wrong time. Study after study has shown that on average investors tend to sell after sharemarkets have gone down, induced by fear instincts, and buy back in after sharemarkets have gone up, as greed instincts take over. This is precisely the wrong strategy for investing in the sharemarket and will likely lead to your MWR being less than your TWR that you would receive if you’d just stayed invested.

The lesson for investors is clear, poor market timing induced by emotion based investor behaviour can result in you achieving returns far less than the sharemarket or your fund manager are delivering. MWR’s versus TWR’s can help you measure this. Your fund manager will provide you with TWR’s and you can either calculate your own MWR’s, or a financial adviser can generally assist you with this.