We review the cases for allocating to Australian companies and international investing, highlighting the diversification benefits from having exposure to companies earning revenues offshore, be they listed domestically or overseas.

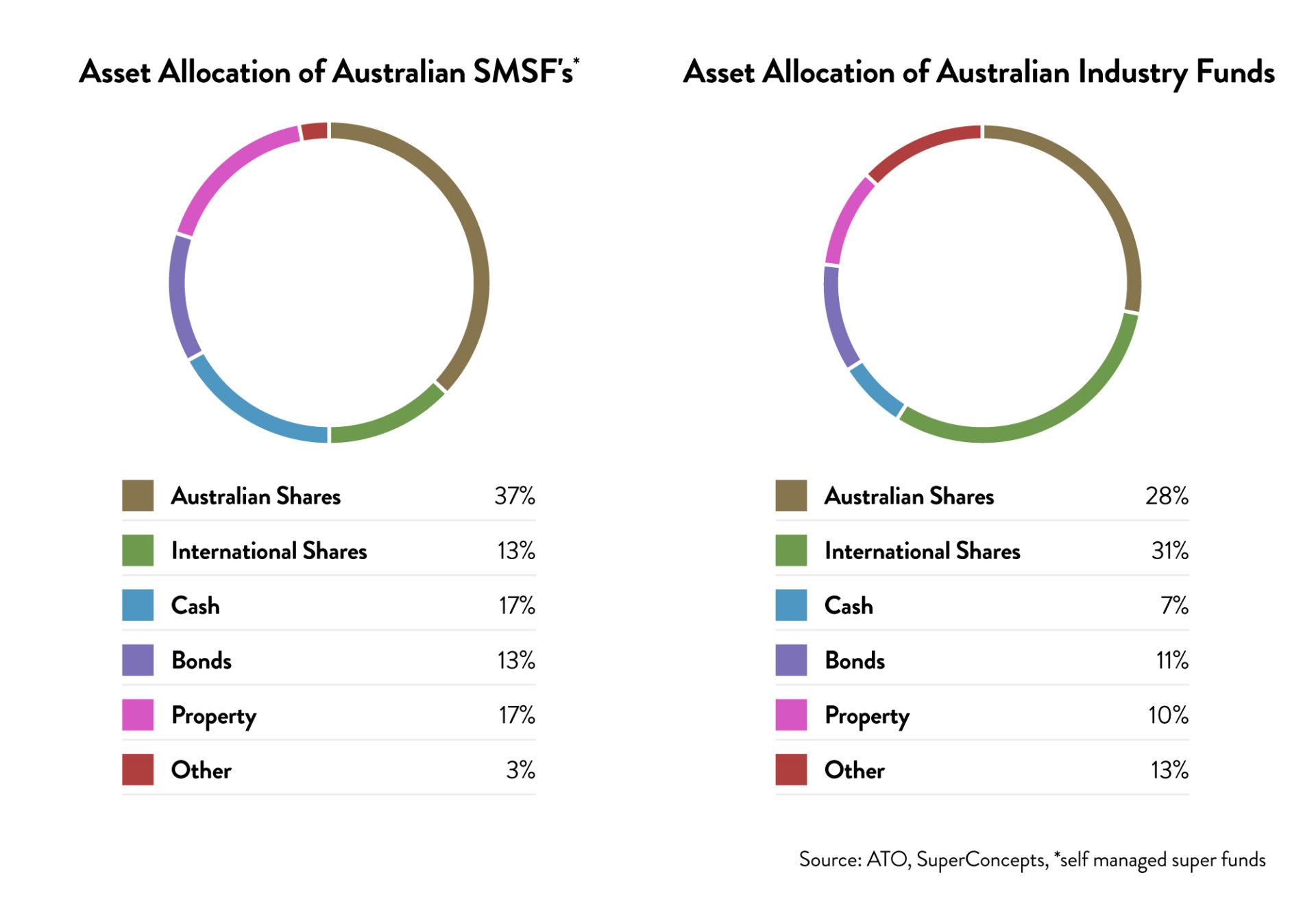

A predicament which investors often find themselves in, surrounds the contentious topic of owning domestic versus international shares. On average, individual Australian investors only hold about 10- to 15% of their balanced portfolios in foreign companies, a surprisingly low amount given academic research and institutional investors guide towards an allocation roughly double that size.

So does this suggest that the average investor should significantly change the composition of their portfolio? Possibly. But this needs to be approached in a measured way, otherwise you run the risk of hurting performance, increasing risk, or both. The appropriate amount of offshore equities to hold depends on numerous factors and will not be the same for all investors. Getting a grasp on the appropriate mix however, requires one to first fully appreciate some of the key influencing factors, such as home country bias, franking credits, currency and diversification.

The case for Australian Companies

In general, investors simply prefer holding assets which they are comfortable with. This “home country bias” normally results in choosing domestic companies over international ones. For example, the typical Australian investor is more familiar with Qantas and Commonwealth Bank, than they are of JP Morgan and Tencent.

In addition to Australian investors being more familiar with the locally based companies, they are also easier to keep track of. For example, they are listed on the domestic stock exchange, they feature prominently in daily business news, and are priced in Australian dollars. And let’s not forget the highly attractive franked dividends, something only Australian stocks pay!

Although home country bias certainly limits the breadth of opportunities available to an investor, it is actually not as much of a restriction as it once was, given how global the businesses now are of many Australian listed companies. For example, if China does well, it will flow through to BHP’s profits. At the same time, offshore earners such as BHP or CSL would likely sail through an Australian recession, provided the global economy was still performing. At Ophir, we are known for having been early investors in a number of Australian companies that have successfully expanded overseas such as Afterpay and A2Milk. It is true that our Funds have significantly higher exposure to companies earning a material portion of their revenues overseas that the Fund’s benchmarks.

So is it the case that by owning a selected list of Australian stocks, we can construct a portfolio which is just as well diversified as a global equity portfolio? Not necessarily. First off, some Australian companies are global, but many are not. In addition, even the Australian companies which generate the bulk of their earnings offshore, tend to be concentrated to just a few sectors (we note though this has been changing more recently in the small cap space). By contrast, getting exposure to the global technology sector through Aussie listed stocks would just not be possible. Finally, considerations such as political, taxation and regulatory issues are unique to the country you invest in, and thus by holding equities in just one single country, you are loading up on those potential risks.

Taking all this together, it’s understandable why Aussie investors gravitate towards their home country stocks. But by doing this, they are taking on unintended risks.

Reasons for International Investing

Without a doubt the strongest case for owning a healthy mix of both Australian and international shares comes from diversification. For example, irrespective of whether we believe Commonwealth Bank is a better or worse company than JP Morgan, one thing which is for certain, is that their operations are predominantly located in different countries. What this means is that Commonwealth Bank is likely to outperform JP Morgan when the Australian economy is growing faster than the US economy, and vice-versa.

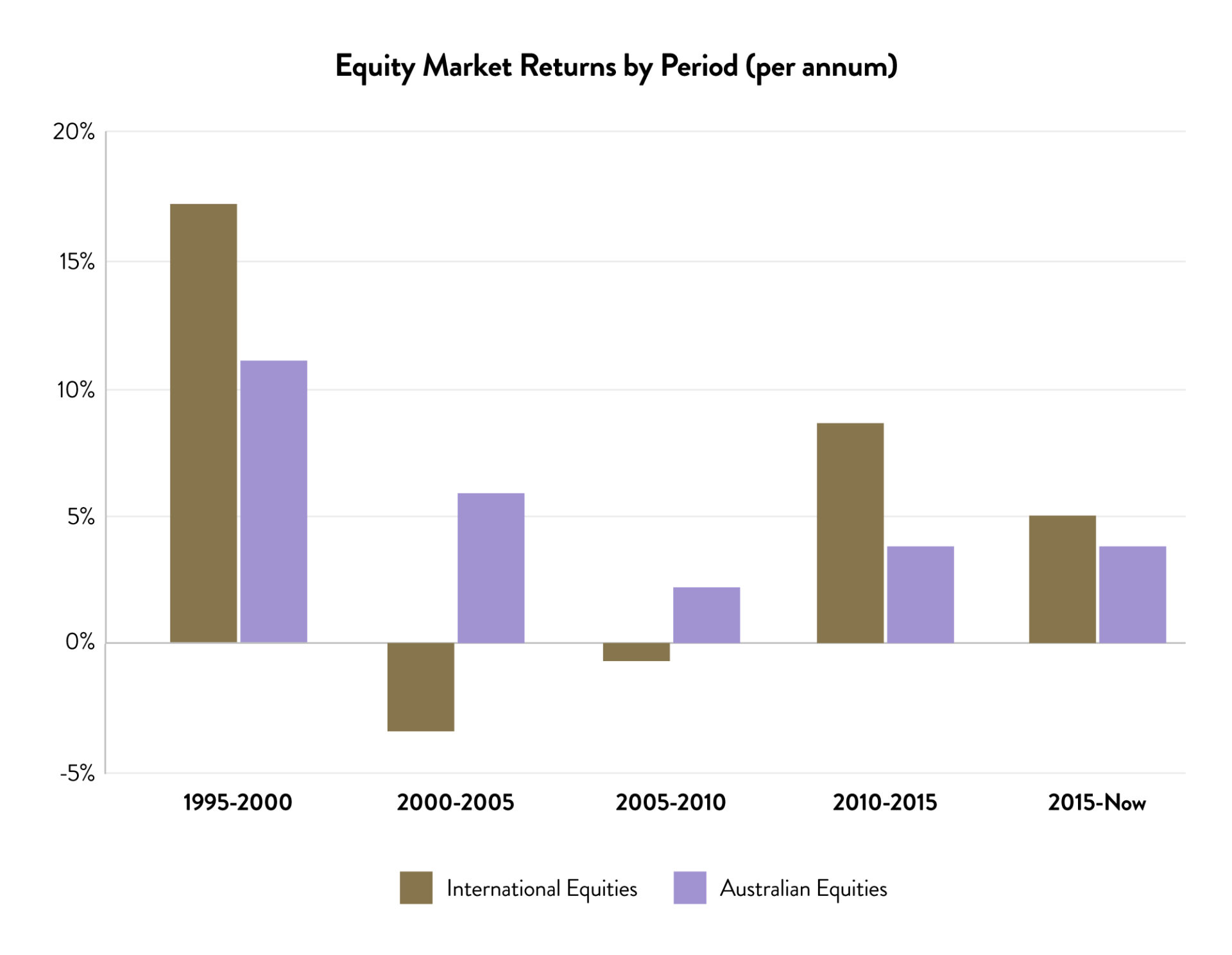

By combining both domestic and international shares, portfolio returns will be smoother and more consistent, as the weak returns in one market are often cancelled out by strong returns elsewhere. This is illustrated in the chart below (left), with Australian shares outpacing international equities from 2000 to 2010, only to lag consistently since. What changes even more dramatically however, is overall volatility, with portfolio risk being reduced as we hold a set of companies which are more geographically diverse.

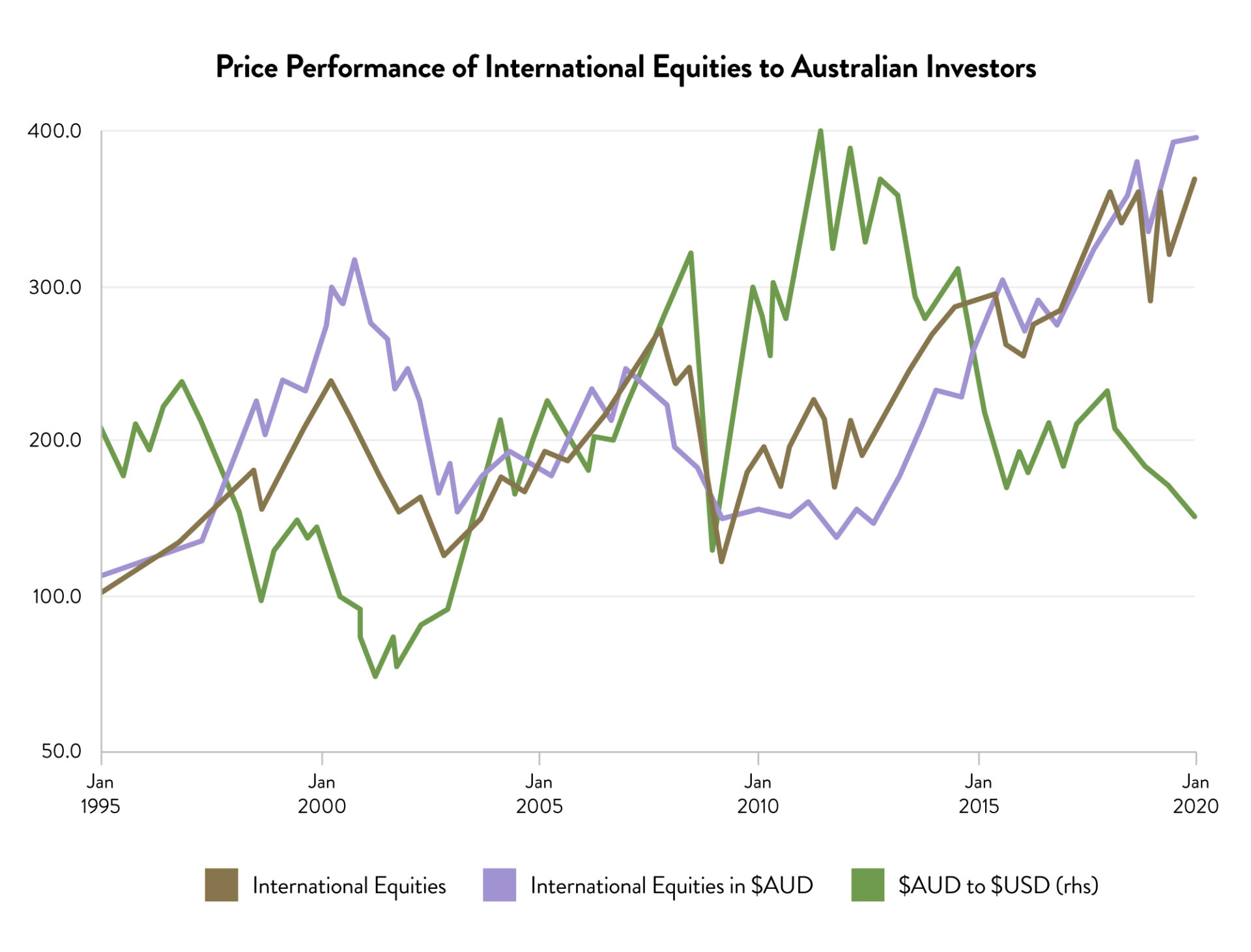

Interestingly, currency risk also supports the case for Australian investors owning international shares (unhedged). Being a known barometer on “global growth”, the Australian dollar’s tendency to fall during periods of economic weakness, means that Australian based investors can realise a boost to the returns of their offshore holdings, just when it’s needed most. This has been seen in a striking manner over the last eight years, where the Australian dollars 40% fall has seen local investors capture returns in excess of 150% on their international equity holdings when measured in Australian dollars.

Making a Decision

In conclusion, strong cases can be mounted for both Australian and international shares, with a healthy mix of both being optimal for most investors. One positive is that global diversification does appear to be getting better. Australian investors have been progressively increasing their international holdings over the last decade, in part because international investing is no longer as complicated and costly as it used to be. And as this current period of economic slowdown continues, a backdrop of continual weakness from the Australian dollar dictates that investors should protect their portfolios, through increasing their exposure to companies which generate earnings outside of Australia, be they listed domestically or offshore.

At Ophir, we recognise the benefits of international investing for our own personal wealth that we invest in the Ophir Funds. Hence our Australian equity funds (the Ophir Opportunities Fund and Ophir High Conviction Fund) have exposure to Australian companies with significant overseas revenues. We have also recently launched more broadly this week our Ophir Global Opportunities Fund, which invests in companies listed overseas that earn virtually all their revenues offshore. We think a mix of both approaches is also likely to be of interest for many other investors.