By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

As investors, when valuations are elevated, it is important that we remain disciplined not only in respect of which companies we add to our portfolios but which ones we exit.

Dear Fellow Investors,

Welcome to the April 2019 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Global equities strong in April

Global equities markets resumed their resurgence in April after a subdued March, buoyed by low interest rates, better than expected US earnings and strong US economic data. The S&P 500 index climbed +4.0% during April with the MSCI Developed Markets index rose +3.8%.

In the first four months of 2019 the Dow Jones Industrial Average (up +13%) and NASDAQ (up +17%) have had their best calendar year start since 1987 and 1999 respectively. Some media commentators have drawn comparisons between the current trajectory of markets and the trajectory which preceded the 1987 Black Monday crash and the 1999 dot com bubble.

We believe that this comparison is unwarranted. In the lead up to the 1987 crash both the US and Japanese economy, the world’s two largest at the time, were booming and the S&P 500 Index was trading at 29 times earnings (compared to 15.5 currently). In the lead up to the 1999 dot com bubble it was touted the internet would change the way we do everything and the NASDAQ was trading at an eye watering 175 times earnings (compared to 19 currently).

While markets may be overheated and remain vulnerable to a decent pullback or correction, in our view low inflation and more dovish central banks means continued market strength is likely in the absence of a macro-economic shock event like a full blown trade war.

As investors, when valuations are elevated, it is important that we remain disciplined not only in respect of which companies we add to our portfolios but which ones we exit – more on that later.

Local markets also rallied although the ASX 200 was one of the worst performing major indexes only lifting +2.4% during April being dragged by an underperforming Resource sector. Within the smaller company space the S&P/ASX Small Ordinaries Accumulation Index rose 4.1%.

We were delighted with the performance of both Ophir Funds during April with the Ophir Opportunities Fund gaining +8.4% net of fees for the month and the Ophir High Conviction Fund rising 6.0% net of fees.

We are hitting the road this month and June to promote the Ophir High Conviction Fund to Financial Planners for the first time. We are very pleased with all the interest we have received since listing. If you would like to arrange a time for us to visit your office, please click here to send us an email and we will endeavour to fit you in.

Nothing emerged in the March data to suggest a rebound in domestic economic conditions and in our view the risk remains to the downside. The 2019-20 Federal Budget saw the Coalition government miss an opportunity to boost subdued business sentiment and ease the pressure on consumers feeling the impact of the negative wealth effect of falling house prices. Further, the International Monetary Fund’s latest outlook estimates Australia’s gross domestic product will cool from 2.8 per cent last year to 2.1 per cent in 2019.

Jumbo Interactive (ASX:JIN) – Mega jackpots and online growth

As outlined in our March 2019 Letter to Investors we continue to rebalance our portfolios into companies with more economically resilient earnings. One portfolio holding we have held for a while is Jumbo Interactive (ASX:JIN), the only authorised online reseller of lottery tickets in Australia.

In our view Jumbo is in a unique position being a smaller capitalisation stock that not only has revenue dynamics that are more normally accustomed to a defensive blue chip stock (i.e. Tabcorp ASX:TAH) but also the structural tailwinds of the shift to online consumption habits.

Lottery ticket sales in Australia has traditionally been considered a boring but dependable low single digit growth industry. However FY19 significantly challenges this view with industry growth accelerating to more than 20%. The acceleration is not by chance (pardon the pun). The rules/odds of the Powerball lottery have undergone its most significant change in its history. The two most important effects have been the creation of mega jackpots – we have seen 2x $100m drawn this financial year – and the chance of players winning smaller payouts more frequently.

The buzz and excitement around mega jackpots has both lured more people into playing and interestingly enticed people to play more when the jackpot is larger. For example, if you were a typical player of Powerball and you didn’t win on any given draw and the jackpot was then doubled, you would most likely buy more than double the amount of games for the next jackpot. So the creation of these mega jackpot runs has seen a parabolic increase in game sales.

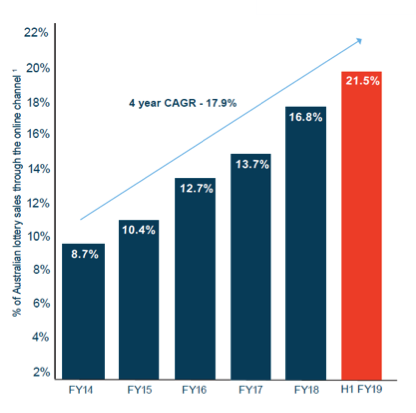

The way people play the lottery is also changing with online ticket sales taking significant market share from traditional offline retailers, predominantly newsagents. Outside of Tabcorp, Jumbo is the only authorised reseller of lottery tickets online. The penetration of online ticket sales has also grown exponentially in the last 12 months to more than 20% of all game sales aided by the frenzy surrounding the mega jackpots.

While we expect the rate of growth to slow in future years as the industry cycles, the emergence of mega jackpots and the increase penetration of online tickets sales should remain an important tailwind for Jumbo. It’s interesting to note online penetration growth has likely seen engagement with a younger demographic supporting an improvement in the quality and potential lifetime value of Jumbo’s users. It should be noted in April and early May we chose to exit most of our holding in Jumbo on valuation grounds as the share price surged.

Exercising selling discipline

Exercising discipline as investors during times like the present when markets are vulnerable to a decent pullback or correction is crucial and one investing discipline that does not receive the attention it should is the discipline to sell.

When speaking to our investors the focus of conversations is inevitably on the companies we added to the portfolio and our rationale for doing so, but internally at Ophir we spend just as much time discussing the companies we are considering either selling or reducing our position in. Broadly speaking there are four reasons we would exit or materially reduce a position in our portfolio:

1. Excessive valuation – This involves exercising the same valuation discipline when selecting companies and not being afraid to recycle capital when an investment thesis successfully plays out. The elevated valuation no longer provides enough margin for safety should market expectations not be met.

During August 2018 we materially reduced our position across both portfolios in Afterpay (ASX:APT) as although we remained supportive of the global rollout of its payment product, we felt market valuations at the time were excessive. At the time management was continuing to grow merchant, customer numbers and transaction values over 200% in Australia. It launched its offering in the USA and purchased Clearpay in the UK to kick start its European operation.

However, our view at the time was with a share price of around $22 the market was implying too much given the overseas operations had just commenced. Further, the market had not priced (or forgotten to price) the impending regulatory review in Australia of the buy now pay later sector.

In December we added to our position in Afterpay again following the passing of the regulatory cloud and positive data emerging from its US roll-out. Put simply when trading at $13 and these risks removed we saw value come back in the stock.

2. Earnings risk – Our investment process identifies high quality businesses whose earnings are typically more resilient to a weaker economic environment or whose underlying earnings drivers are well protected (either through high operating margins, a deep competitive advantage or a dominant market position). Where a portfolio company’s earnings quality is threatened for any reason, we will assess the potential impact and depending on its significance, may decide to exit our position.

A recent example was our decision to exit our position during Q3 2018 of New Zealand based fuel retailerZ Energy (ASX:ZEL). Management did an excellent job integrating its 2015 acquisition of Caltex New Zealand and was in the process of realising its targeted synergies, gaining the benefits of increased scale from its enhanced retail footprint and commenced paying down its debt after not raising capital and diluting shareholders as part of the deal.

But a 25% rise in crude prices in 2018 coupled with the 9% depreciation of the NZ dollar against the US led to record high prices at the pump. Consumers inevitably became more price sensitive as prices pushed over NZ$2.29 a litre and decided to either fill up at lower priced fuel operators or simply fill up to a dollar value if it was too expensive to travel to the cheaper alternative.

This reduced Z Energy’s retail volumes with no significant positive tailwinds to offset this impact. This confluence of events heightened our anticipation of an earnings shortfall and lead to our decision to exit our position. Z Energy subsequently downgraded earnings twice during the year, both in July and November as earnings were revised from $450-485m to $400-435m, a 10.7% reduction.

3. Change of stock thesis – Before we deploy our investors’ capital into a new position we will always articulate reasons why we believe the underlying business will deliver a meaningful return on investment. Rigorous debate among our investment team is a fundamental part of our investment process and no new investment is made unless underlying assumptions have been challenged and risks sufficiently considered. When events take place which change our stock thesis we act swiftly to reassess the investment and this may result in us exiting the position.

A recent example where we exited a position because of a change in investment thesis is Premier Investments (ASX:PMV), which owns retail brands Smiggle, Peter Alexander, Portmans, Dotti, Jay Jays, Just Jeans and Jacqui E. Our thesis holding Premier Investments in the portfolio was Smiggle as the fastest growing brand within Premier Investments’ portfolio would become a larger proportion of earnings as it is rolled out globally. Thereby accelerating profits without calling on shareholders to fund this growth.

However with the rapidly changing global retail landscape, particularly with the advent of online and the impact on traditional bricks and mortar, management justifiably decided to slow down Smiggle’s global retail rollout. It has instead decided to implement a more capital light wholesale model and rely on trusted global retail partners to use their existing network to roll out the Smiggle brand.

While this strategy is lower risk from a capital deployed perspective, an element that cannot be easily forecasted is how fast (or slow) its retail partners can plan, order, merchandise, market and ultimately resupply the Smiggle product within their own retail network. We still believe Smiggle will become a global sensation, however, our experience with companies transitioning their strategy is it’s generally better to watch the execution from the sidelines until it is apparent that is working. As a result of the change in thesis we decided to exit our position in Premier Investments. We remain key observers of the execution of the new strategy.

4. A better stock comes along – Our investment process is designed to build high conviction in the companies we hold in our portfolios so each position holds a meaningful portion of the overall portfolio. When we identify a company which is growing quickly and represents better value than an existing position with a less leveraged balance sheet, we challenge ourselves as to why we shouldn’t exit an existing position and replace it with the ‘better stock’. This discipline ensures we always maintain a philosophy to hold the “best of” investment opportunities rather than amass a long tail of mediocre investment ideas.

With periods of volatility likely to persist, exercising strong selling discipline will be important to ensure we continue to recycle our investors capital into businesses that deliver the best return on investment at the time.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

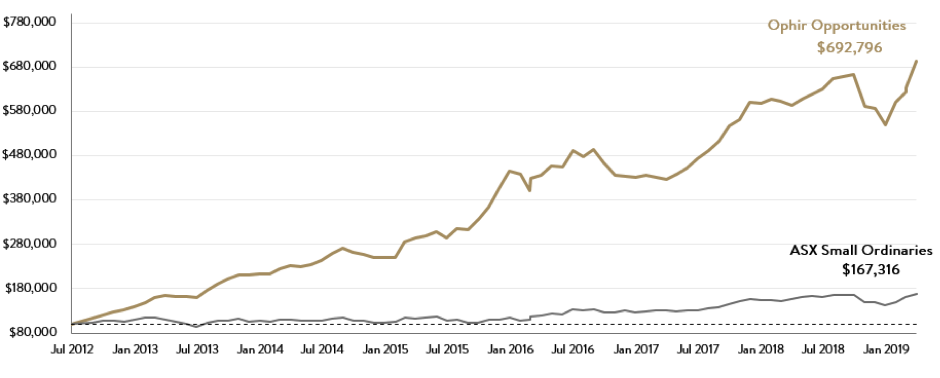

The Ophir Opportunities Fund

Growth of A$100,000 (pre all fees) since Inception

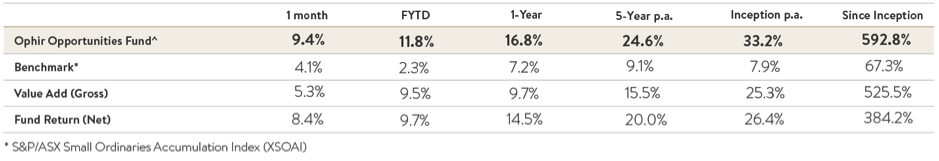

The Ophir Opportunities Fund returned +9.4% for the month outperforming the benchmark by 5.3% before fees. Since inception, the Fund has returned +33.2% per annum, outperforming the benchmark by 25.3% per annum before fees.

| 1 Month | 1 Year | 5 Year (p.a.) | Inception (p.a.) | Since Inception | |

| Ophir Opportunities Fund (Gross) | 9.4% | 16.8% | 24.6%p.a. | 33.2%p.a. | 592.8% |

| Benchmark* | 4.1% | 7.2% | 9.1%p.a. | 7.9%p.a. | 67.3% |

| Gross Value Add | 5.3% | 9.7% | 15.5%p.a. | 25.3%p.a. | 525.5% |

| Net Fund Return | 8.4% | 9.7% | 20.0%p.a. | 26.4%p.a. | 384.2% |

* S&P/ASX Small Ordinaries Accumulation Index (XSOAI)

| Buy Price | Mid Price | Exit Price | |

| February 2019 Unit Price – Opportunities Fund | 2.6962 | 2.6868 | 2.6774 |

Key contributors to the Opportunities Fund performance this month included Afterpay Touch (APT), Jumbo Interactive (JIN) and Kogan.com (KGN). Key detractors included Pilbara Minerals (PLS), Macmahon Holdings (MAH) and Aurelia Metals (AMI).

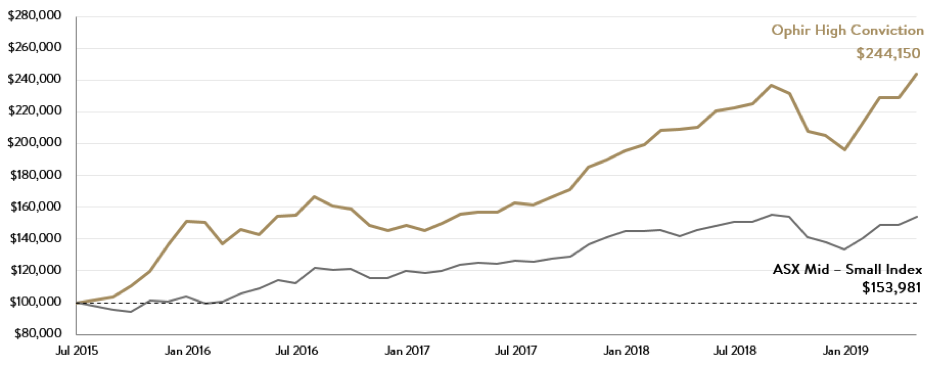

The Ophir High Conviction Fund

Growth of A$100,000 (pre all fees) since Inception

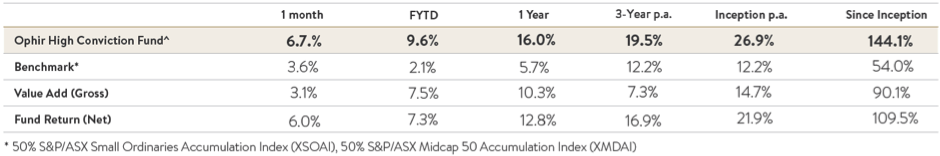

The Ophir High Conviction Fund returned +6.7% for the month, outperforming the benchmark by 3.6% before fees. Since inception, the Fund has returned +26.9% per annum, outperforming the benchmark by 14.7% per annum before fees.

| 1 Month | 1 Year | 3 Year(p.a.) | Inception (p.a.) | Since Inception | |

| Ophir High Conviction Fund (Gross) | 6.7% | 16.0% | 19.5%p.a. | 26.9%p.a. | 144.1% |

| Benchmark* | 3.6% | 5.7% | 12.2%p.a. | 12.2%p.a. | 54.0% |

| Gross Value Add | 3.1% | 10.3% | 7.3%p.a. | 14.7%p.a. | 90.1% |

| Net Fund Return | 6.0% | 12.8% | 16.9%p.a. | 21.9%p.a. | 109.5% |

* 50% S&P/ASX Small Ordinaries Accumulation Index (XSOAI), 50% S&P/ASX Midcap 50 Accumulation Index (XMDAI)

| NAV | |

| 30 Apr 2019 NAV – ASX:OPH | $2.61 |

Key contributors to the High Conviction Fund performance this month included Afterpay Touch (APT), A2 Milk Company (A2M) and Reliance Worldwide (RWC). Key detractors included Mercury NZ (MCY), Evolution Mining (EVN) and Northern Star Resources (NST).

This document is issued by Ophir Asset Management (AFSL 420 082) in relation to the Ophir Opportunities Fund & the Ophir High Conviction Fund (the Funds) and is intended for wholesale investors only. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir Asset Management accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. Any investment decision in connection with the Funds should only be made based on the information contained in the Information Memorandum and/or Product Disclosure Statements.