With this current bull market in equities now more than 10 years old it is not surprising that some voices are suggesting that investors would be wise to take profits before prices turn downwards. We review the evidence for market timing and why a strategy for staying invested is generally the best.

Every investor will experience times when it is hugely tempting to sell out, particularly through periods when newspapers and market commentators drive a sense of panic. And with this current bull market in equities now more than ten years old, it’s not surprising that some voices are now suggesting markets have peaked, and that investors would be wise to take profits before prices turn downwards. It is our belief however that mistakes often happen when emotions dictate an investors decisions, and that the best thing to do during these times is to just hold your nerve, and remain focussed on your long term goals. Put simply, just keep calm and stay invested!

Don’t Try to Time the Market

Countless academic studies have shown that trying to buy at the bottom and sell at the top, is incredibly difficult, if not impossible to do consistently, and hence such attempts are best avoided. There are numerous reasons why strategies which attempt to “time the market” in such a way generally fail. For example, no one can accurately say how long each market cycle will last, or if it has already ended. And even when it’s clear that we have transitioned into a bear market, we do not know how deep and long it will be.

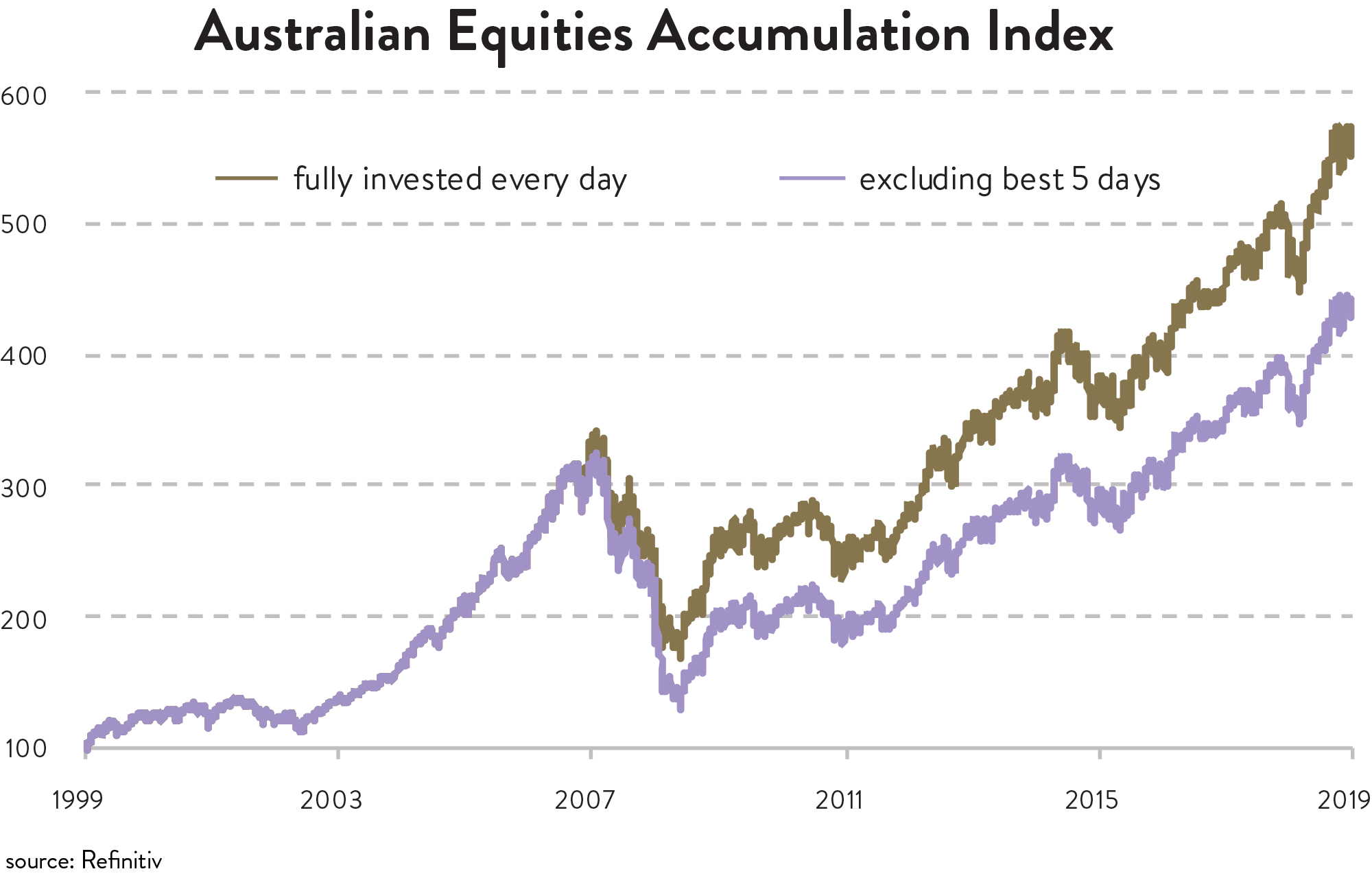

Trying to predict market activity over short time periods, is also a dangerous strategy, as investors can end up missing some of the best days when markets rebound. For example, if you just missed the top 5 best days on the Australian stock market over the last twenty years, your overall return would be cut by almost 40%! That’s a staggering difference for only 5 days over a two decade period, but it starkly illustrates how sharp some short term moves can be, and how critical it is that you remain in the market and can therefore capture those bounces when they happen.

Good Follows Bad

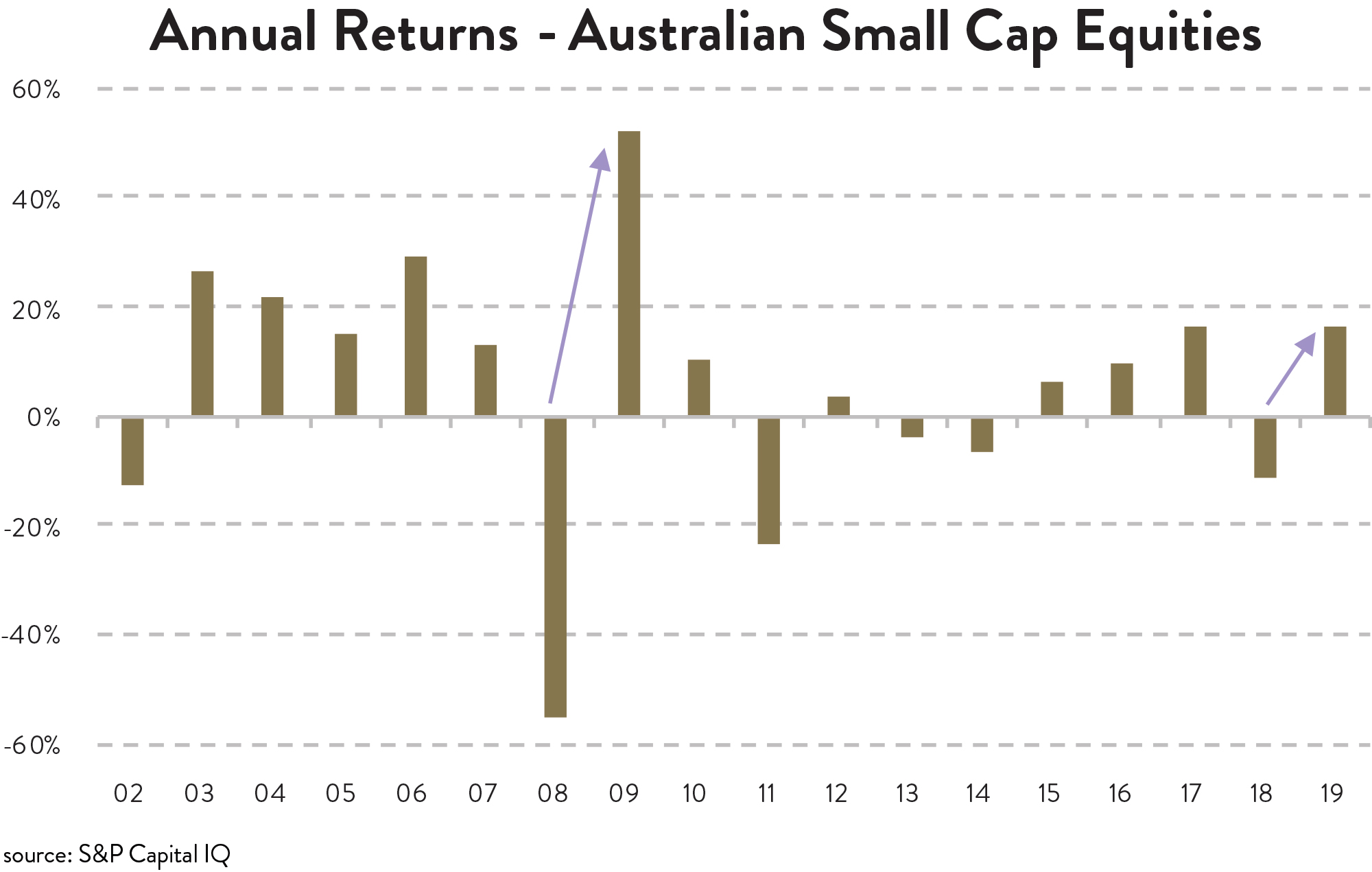

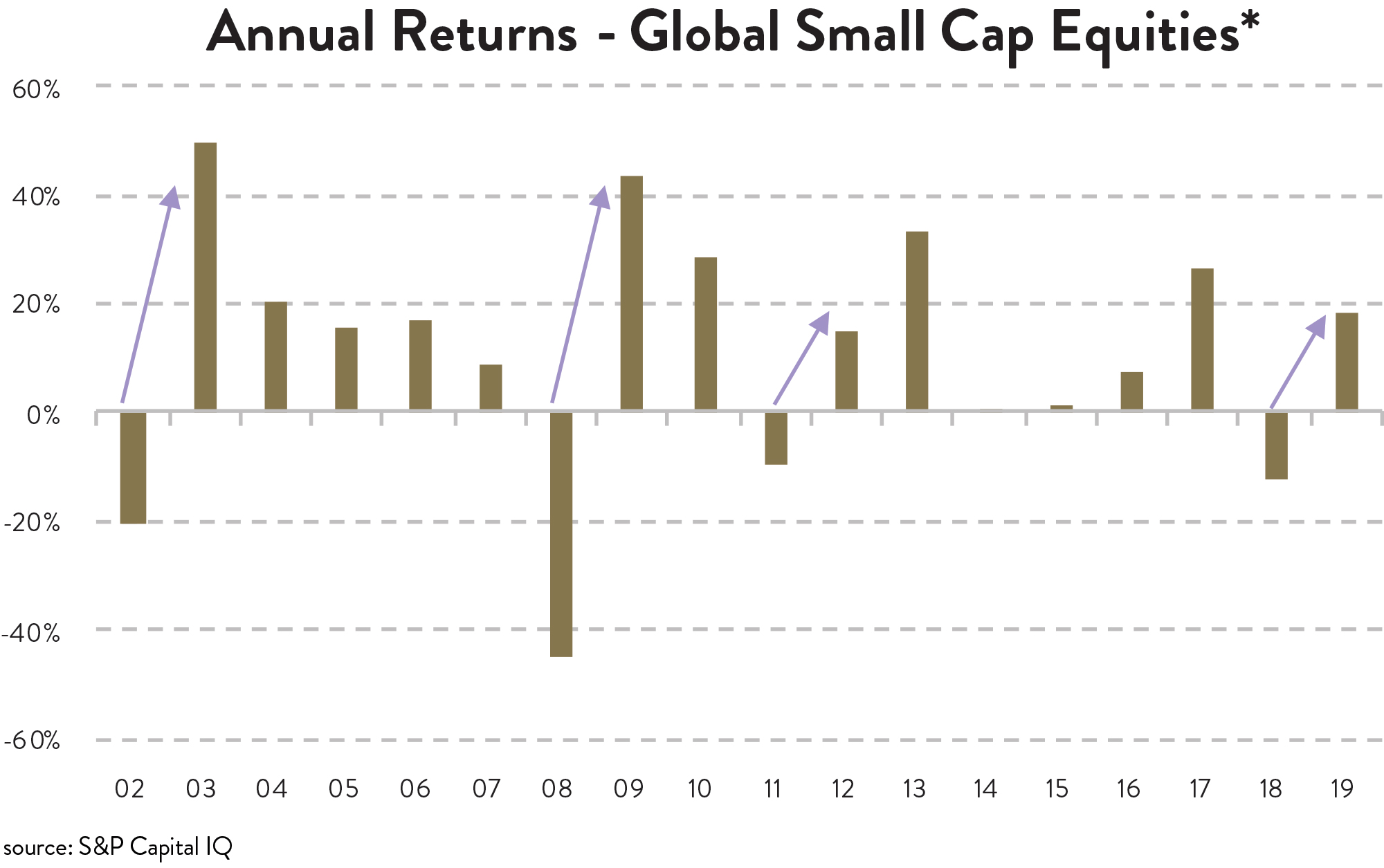

Another important lesson from history is the tendency for equity markets to stage their best years immediately following a bear market. We see this both in Australia and offshore, with a pattern emerging whereby the deeper the bear market, the stronger the subsequent rebound. This inherent cyclicality in stock markets means that investors who hold their nerve through the tough times, are subsequently rewarded for their patience. By contrast, investors who pulled out near the bottom not just suffered the pain of the down years, but missed the opportunity to participate in the markets inevitable recover.

The lesson here is that although losses can be experienced over shorter time periods, the key is to avoid the temptation to exit the market at these low-points. Instead, the coming rewards of the inevitable economic recovery will only be realised by those investors who have the patience to remain invested.

Invest Like the Best

Something which almost all accomplished investors are likely to tell you, is that a key behind their success in building wealth, has been their ability to ride out market gyrations, and stay focussed on their long term goals. We agree, and in our opinion investors should plan to hold equity investments for at least 5+ years.

In addition, focussing on the long term is actually a less stressful way to invest, as you are not having to constantly second guess each market development. By removing unnecessary emotion you can avoid making the costly mistakes which overreacting often leads to.

The brutal fact is that trying to catch the tops and bottoms is a fallacy, which is why nobody has ever managed to successfully time markets over multiple cycles. But by controlling your emotions, and not capitulating to either fear or greed, you give your investments a chance to grow and participate in the wealth creation process that owning a set of businesses can provide.

At Ophir, if you give us $1 of your money, we will generally always have the vast majority of that at work invested in companies, usually around or in excess of $0.90. We don’t try and move that figure around based on our views of markets. We aim to keep our portfolios close to fully invested with only a small amount of cash available such that at any one time if 1-3 great opportunities presented themselves, we could invest immediately, without having to sell other companies. One need only look to the December quarter of 2018 when sharemarkets globally corrected and many investors and managers reduced their exposure to the market in fear, only to be caught out and miss the rebound in 2019 when the US Fed came to the rescue with interest rate cuts.

And with that, we’ll leave the final word to Warren Buffett who we think has stated the pitfalls of trying the market about as well as anyone else:

“Periodic setbacks will occur, yes, but investors and managers are in a game that is heavily stacked in their favour. (The Dow Jones Industrials advanced from 66 to 11,497 in the 20th Century, a staggering 17,320% increase that materialized despite four costly wars, a Great Depression and many recessions. And don’t forget that shareholders received substantial dividends throughout the century as well.) Since the basic game is so favourable, Charlie (Munger) and I believe it’s a terrible mistake to try to dance in and out of it based upon the turn of tarot cards, the predictions of “experts,” or the ebb and flow of business activity. The risks of being out of the game are huge compared to the risks of being in it.” Warren Buffett