As we approach the one year mark of listing the Ophir High Conviction Fund, we take a step back and delve more deeply into the reasons why it was listed, whilst also answering some common investor questions on the Listed Investment Trust structure.

When selecting a managed fund, investors have many choices to make: Aussie versus global, equities versus bonds, passive versus active. One choice which is often overlooked however, is on the topic of open-end versus closed-end funds. And although this may seem an unexciting topic, there are occasions where it may actually be a very important decision.

For almost one year now, the Ophir High Conviction Fund has been trading as an investment trust on the Australian Stock Exchange under the ticker code OPH. Our decision to convert this fund into a closed ended vehicle was taken after careful consideration, and involved detailed discussions with many stakeholders. Key to this change was our belief that this structure would allow for a better alignment on the primary common interest we share with our unitholders, that is to achieve the best possible investment returns over the medium and long term. Importantly, through the conversion to a listed investment trust (LIT) we didn’t raise any new capital from investors.

We are pleased with the performance our High Conviction Fund has generated over its first year, and still firmly believe that the conversion to a closed-ended vehicle was the right choice. At the same time, we are conscious that not all our investors are fully aware of the reasoning behind our switch. We therefore thought that now would be a good opportunity for us to explain why we made the transition, as well as answer some of the questions we hear from our investors on this topic from time to time.

The Benefits a Listed Trust Offers

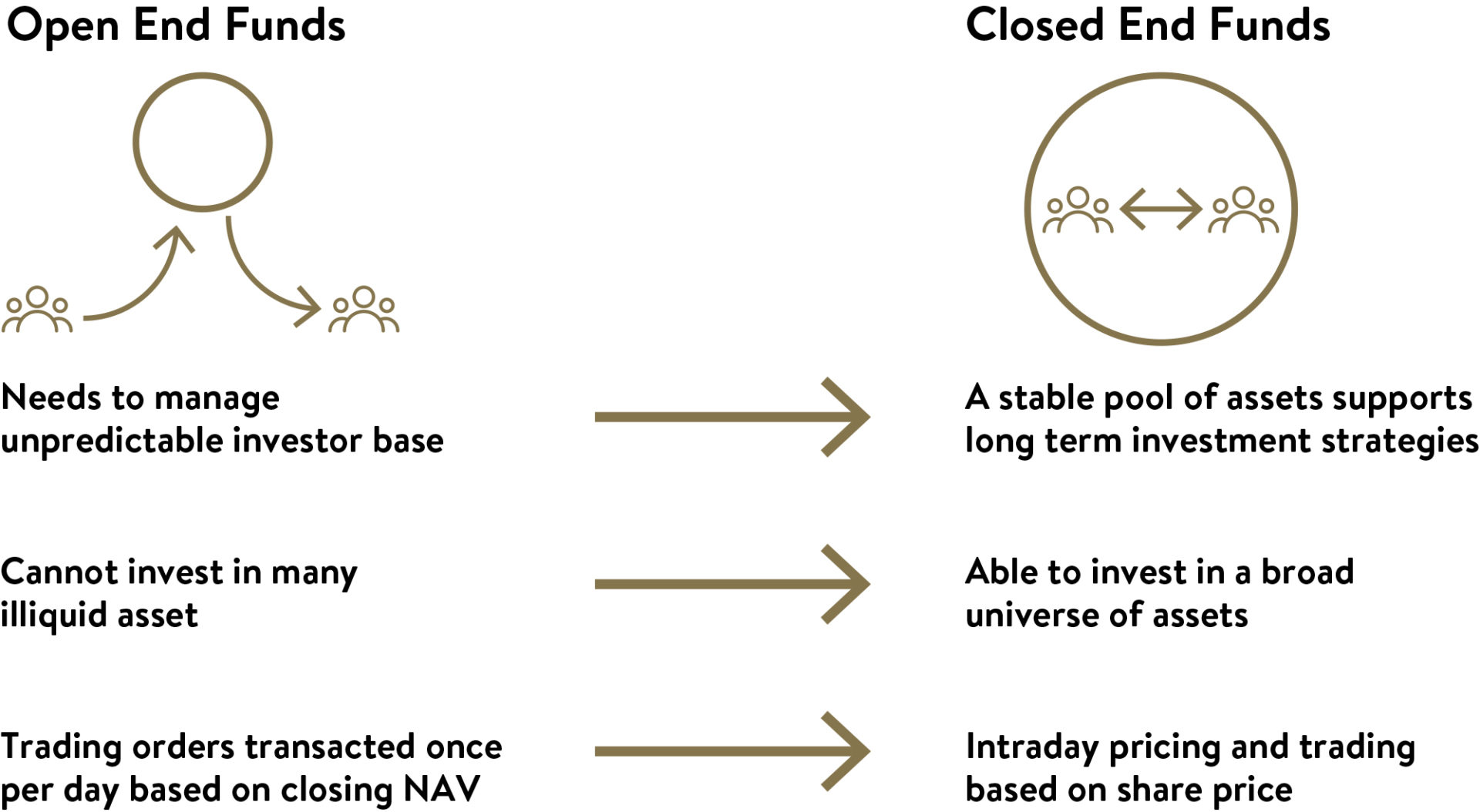

In explaining the advantages a closed-end fund offers, we need to contrast it with the open-ended structure that was utilised prior to listing. At the same time, we should take a step back, and consider some of the challenges a fund manager faces as they endeavour to grow client’s wealth.

The Importance of Managing Capacity

Capacity is an important but often ill-defined concept, relating to how much money can be invested in an actively managed strategy without harming that strategy’s future returns. Smaller pools of money allow the investment manager to rotate between stocks quickly, and with minimal pricing impacts. However, once a fund grows its assets under management beyond a certain amount, i.e. beyond its capacity, the portfolio manager can face difficulties building meaningful positions in stocks. The portfolio manager may also find that they adversely move the price of stocks, as they attempt to build or reduce positions, reducing portfolio returns. As Warren Buffett has said “Anyone who says that size does not hurt performance is selling”. “It’s a huge structural advantage not to have a lot of money (to invest)”[1]. Many of you will have heard us say, we’d rather be like the nimble speedboat avoiding the icebergs (market and stock risks), rather than the slow Titanic that has to begin turning very early to avoid potential icebergs that can sink the ship!

Capacity is particularly relevant when investing in the smaller and less liquid stocks on the market, and hence Ophir made the decision early last year to cease taking any additional investments into the High Conviction Fund, after being open for only about two and half years. Similarly, we closed our original fund, the Ophir Opportunities Fund to all additional investments back in 2015, after being open for only just over three years. In both these instances, our decision that these funds had reached capacity level was taken to ensure that the underlying investment strategy can continue operating optimally and give ourselves the best opportunity to continue generating outperformance.

A consequence of capping the size of an open-ended fund, is that new investors are unable to gain exposure to our fund’s strategy. Existing investors could be similarly frustrated as they are unable to increase their exposure. But by listing the High Conviction Fund on the ASX as a closed-end vehicle, investors are free to buy and sell the fund, with the same level of freedom and flexibility as they would with any company listed on the market. Importantly, both of us can also continue investing into the High Conviction Fund to maintain alignment with our investors and continue to put our capital to work.

Under this closed-end structure, investors who seek an avenue into the performance of Ophir’s funds will still be able to gain access, as long as existing unit holders are willing to sell the shares they already own. At the same time our team of stock pickers can continue to take advantage of attractive investment opportunities, but without the liquidity constraints which large funds generally face.

Maintaining a Stable Capital Base

We strongly believe that one of the keys to the outperformance we have generated on our portfolios, has been our ability to ride out market gyrations, and stay focussed on long term goals. And to reach these long-term goals, we believe that investments in our Funds, including the High Conviction Fund should ideally be held for at least five years.

Probably the issue which most challenges an investment managers ability to remain long term focussed, are the liquidity constraints which come when running an open-ended fund. Because the pool of funds available to be invested isn’t fixed under this structure, the portfolio manager has to ensure that there is always enough cash on hand to meet redemptions from clients. On the flip side, through periods when investor applications exceed redemptions, the portfolio manager will be pressured to deploy that capital into the market, even if they believe stock prices may be overvalued.

These pressures can be particularly acute in periods of heightened market volatility, when redemption activity can increase considerably. For example, through the financial crisis period of 2008, many small cap managers were forced into selling key portfolio holdings at sub-optimal prices, so as to raise cash and meet investor redemptions. By contrast, the investment managers with stable pools of capital were able to take advantage of the forced sellers, by acquiring these parcels of shares at often bargain prices.

We were fortunate ourselves to experience the benefits a stable capital base provides when managing a portfolio at our previous employer through the GFC and generate market leading performance. This foundation of long-term patient capital gave us a distinct advantage versus our peers who were facing strong redemptions through the financial crisis period, setting us up for market leading performance of +131.3% over calendar year 2009.

By converting to the closed-end structure, its means that as portfolio managers we don’t need to manage daily inflows and outflows from investors buying and selling shares. This will allow the High Conviction Fund to remain optimally invested in line with its strategy, rather than needing to hold cash aside like an open-end fund. Most importantly it provides us with the freedom to take long term views on the companies we invest in.

Liquidity and Transparency

Just like the stock of any company on the Australian Stock Exchange, listed closed-end funds can be bought and sold by investors at any time throughout the day. Their share price at any point in time is solely determined by market supply and demand, exactly the same as with any other stock listed on the ASX.

Open-ended funds follow a more staggered trading process, whereby the selling of units requires a redemption form to be filled out and submitted, after which the investor would receive the value of their units based on the prescribed net asset value per unit at end of day. Although nothing is wrong with this process, the steps and time involved can leave investors feeling somewhat detached from the transaction. By contrast when buying and selling a listed closed-end fund, the investors is transacting with reference to a live share price.

Finally, it’s also worth highlighting that closed-ended funds do not have minimum investment requirements when purchased on the secondary market. What this means is that by purchasing even one single share, an investor can buy into the fund. And because they trade on an exchange, closed-end funds do not carry any ongoing distribution costs or fees.

Our Most Frequent Questions From Investors

Over the last year we have received questions from investors related to the High Conviction Fund’s conversion to a closed-ended vehicle as a LIT. As significant investors in the fund ourselves, we have been happy with this engagement, and thought we would highlight some of the most frequently questioned topics.

Does being a closed-end fund change the investment strategy?

No, we analyse companies and manage our portfolio with the same overriding goal irrespective of whether the fund is open or closed-ended – that is, to generate strong investment returns over the long term.

Is a closed-end fund likely to perform better than an open-ended one?

Over short-term time horizons, and when normal market conditions prevail, the closed-end and open-end fund structure should both deliver similar investment returns. If the register of investors is dominated by retail investors, then during more volatile investment markets the premium or discount to Net Asset Value is generally procyclical with investor sentiment. That is during market downturns, when investor sentiment is low, premiums tend to shrink or discounts tend to grow, and vice versa during strong market gains. All else equal this can see closed ended funds out or underperform open ended equivalents depending on the market environment. Over longer time periods however, such as the investment horizon for the Ophir High Conviction Fund, the manager of a closed-end fund, particularly in an asset class like small and mid-cap equities, should be able to deliver stronger returns, due to the advantage they have in being able to hold onto their quality companies, and acquire undervalued companies, through periods of market stress. In comparison, the manager of an open-end fund is often forced into selling off their highest quality companies at undervalued prices through such bear market periods. Loyal investors in open ended funds during these periods are often left as investors in the remaining lower quality less liquid stocks in the fund. Academic evidence tends to support this proposition that closed end funds don’t suffer the performance drag from having to fund investor redemptions at inopportune times.[1]

Why not also list the Ophir Opportunities Fund?

Although we believe a closed-end structure works best for both us and our investors, at this stage we will not be listing in the Opportunities Fund. Versus the High Conviction Fund, the Opportunities Fund is smaller in size, and therefore carries a smaller investor base. This lack of liquidity could make the fund more susceptible to trading away from its NAV, particularly through periods when the broader equity market is struggling.

Why do closed-end funds sometimes trade at a discount to NAV?

When investors buy or sell an open-ended fund, the transaction price is based on the fund’s net asset value (NAV). But by being an exchange traded security, a closed-end funds price is determined by the market supply and demand at that point in time. What this means is that the price of a closed-end fund typically trades at either a premium or discount to the NAV, reflecting the balance between the supply from exiting investors versus demand from those entering.

Academic studies have shown that, over the long term, closed-end funds on average trade at slight discounts to NAV. As above, this tends to deepen when markets go down, while it narrows or moves to a premium when markets go up and investors become more optimistic. This could be due to the shareholders base of closed-end funds being dominated by retail investors, whom are generally quite pro cyclical in their investment attitudes.

Investors in closed-end equity funds should be aware that the share price will rarely match the NAV exactly. Discounts and premiums can occur over time and are generally a function of a number of factors including:

- The market environment and its impact on investor sentiment

- The proportion of retail investors on the fund register

- The size of the fund and the liquidity of the underlying holdings

- The performance track record of the manager

- The quality and frequency of investor marketing and communications

They should also be aware that the discounts which the fund occasionally trades at versus its NAV could actually be a great opportunity to purchase additional units.

Are closed-end funds the same as ETF’s?

No they are not. Both closed-end funds and exchange-traded funds (ETFs) trade on the stock exchange, however this is where the similarities end. Firstly, ETF’s are generally passive investments which aim merely to track the performance of a specific index. Close-end funds by contrast are actively managed, meaning the fund manager aims to outperform the relevant index. Secondly, in a closed-end fund both the pool of capital and number of shares outstanding are fixed, whereas ETF assets are variable as investors buy and sell its shares.

Should investors choose: an open-end or a closed-end fund?

The answer to this depends on a number of factors including the underlying assets which the fund invests in. For big and liquid markets, such as large-cap equities, an open-ended fund is probably the right choice. In contrast, closed-end structures can be a better choice for funds which invest in less liquid assets, such as small cap equities, credit and real-estate. From our experience, the closed ended structure can convey benefits in us seeking our return goals for investors over the long term. We remain aligned with underlying investors in pursuit of this goal as substantial investors and with our single largest investment in the High Conviction Fund.

[1] Business Week (June 1999)

[2] Edelen, R 1996, Investor flows and the assessed performance of open-ended mutual funds, Journal of Financial Economics.